National headlines about a potential housing price decline have raised questions across Utah communities. Rising mortgage rates, slower buyer activity, and growing new-construction inventories are changing local dynamics. Yet housing rarely collapses nationwide without a deep financial crisis. For Utah residents, the short answer is that 2026 is more likely to bring stagnation or modest correction in select markets rather than a nationwide collapse. A closer look at the signals, the unique Utah context, and practical strategies for buyers, sellers, and investors clarifies where opportunity and risk coexist.

Key signals: why sellers are piling up and buyers are thinning

Multiple national measures point to growing pressure on demand. One widely cited indicator shows sellers outnumbering buyers by historically large margins. Builders, who expanded aggressively during the post-pandemic boom, are now reporting large numbers of completed but unsold homes—levels not seen since the aftermath of the 2008 financial crisis. At the transaction level, nearly 60 percent of homes sold in recent months required at least one price cut, suggesting that listing prices are meeting resistance.

These signs indicate that affordability limits are binding. Mortgage rates that jumped from historically low levels in 2021 to the mid and high single digits have reduced monthly purchasing power for many buyers. Where price growth outpaced income growth—particularly in overheated metro areas—natural corrections are occurring as the market rebalances.

History matters: why nationwide catastrophes are rare

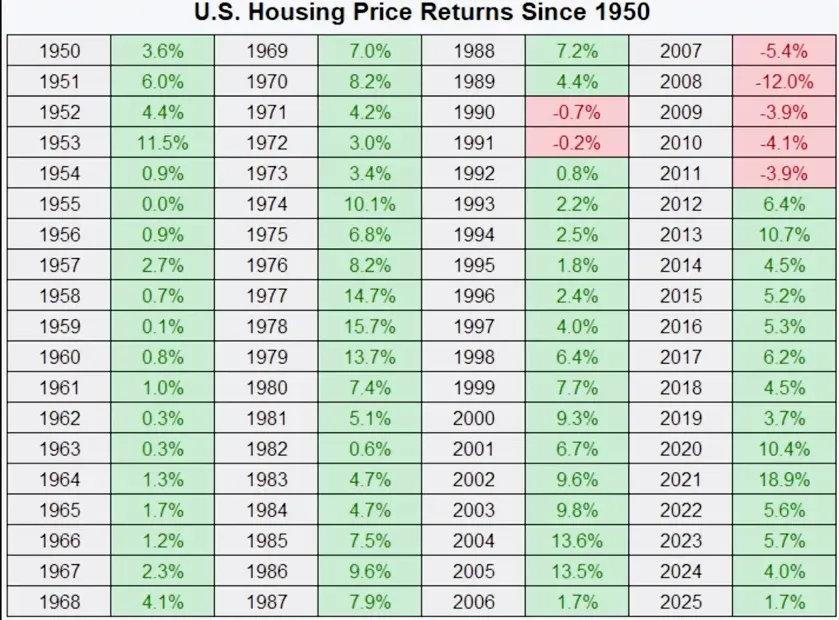

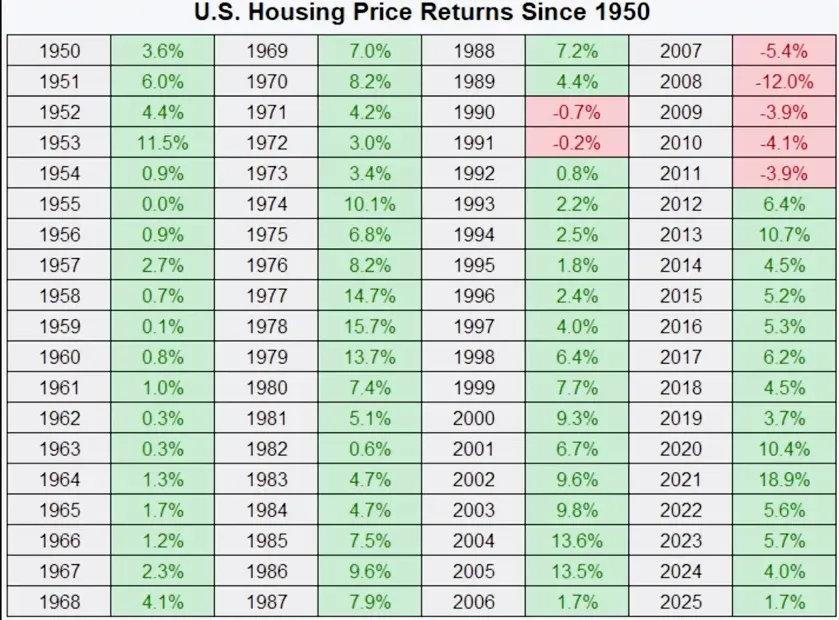

Nominal home prices in the United States have rarely declined on a national basis. Over the past 70-plus years, broad price declines have clustered around major systemic crises. Recessions and normal economic cycles often produce small dips or periods of flat pricing, but a sweeping 20 to 30 percent national decline requires a severe disruption to credit markets or a broad collapse in lending standards. The structural vulnerabilities that created the 2008 meltdown—loose underwriting, excessive leverage, and complex securitization practices—are not present to the same degree today. Loan-to-value profiles are generally stronger, and underwriting standards are materially tighter.

Real estate is local: Utah’s market will not move as one

Patterns that appear dramatic nationally are unevenly distributed across cities and regions. Some municipalities that experienced rapid gains during 2020–2022 are now working through reversion, while other areas continue to record modest appreciation. In Utah, the market mix includes large metropolitan centers such as Salt Lake City, high-amenity resort towns like Park City, rapidly growing Sun Belt-style pockets such as St. George, and smaller, commuter-oriented suburbs. Each of these submarkets responds to affordability, employment, population flows, and local supply differently.

Inventory trends and buyer-seller balance vary by county and neighborhood. For example, areas that attracted substantial remote-worker relocations and speculative demand during the pandemic may see more pronounced price normalization. Conversely, markets with persistent job growth, constrained land supply, or strong rental demand may hold value better.

How national signals translate to Utah neighborhoods

Utah’s recent years of rapid growth and migration have left an uneven footprint. Salt Lake City continues to attract tech and professional services employment, putting upward pressure on prices in desirable neighborhoods. St. George and southern Utah communities have recorded significant in-migration from high-cost states, bringing development momentum and demand for new construction. Park City remains a special-case market driven by tourism, second-home purchases, and limited inventory.

Explore Utah Real Estate

83 W 850 S, Centerville, UT

$815,000

Bedrooms: 5 Bathrooms: 3 Square feet: 3,999 sqft

653 E RYEGRASS DR #305, Eagle Mountain, UT

$387,900

Bedrooms: 3 Bathrooms: 3 Square feet: 1,985 sqft

2031 N LAVA ROCK CIR #107, St George, UT

$4,185,000

Bedrooms: 4 Bathrooms: 5 Square feet: 5,404 sqft

At the same time, increasing inventory in newly built subdivisions and production homes raises the probability of localized price softness, especially where builders are heavily discounting or offering mortgage buydowns to move product. Buyers who are patient and selective may find opportunities in these corridors. Sellers in formerly hyperheated pockets should prepare for longer marketing times and the possibility of price reductions.

Demographics: a built-in base of demand

Population structure supports durable housing demand in Utah. The largest adult cohort nationally and in many parts of Utah sits firmly in prime homebuying ages. Households in their early 30s to early 40s are forming families, seeking stability, and participating in the housing market even when rates are elevated. These life events are powerful demand drivers that do not disappear because mortgage rates temporarily rise. That demographic tailwind distinguishes typical cyclical slowdowns from catastrophic market collapses.

Interest rates, jobs, and the 2026 base case

Forecasting the next 12 months requires threading multiple variables. If mortgage rates remain above six percent and employment momentum softens, a modest correction or extended stagnation in median prices is a reasonable base case. Prices could stagnate or slip slightly while incomes and savings recalibrate. If job cuts become widespread and push unemployment meaningfully higher, that would increase downside risk. However, a 2008-style crash generally requires systemic credit stress rather than a conventional slowdown.

What this means for Utah buyers

Buyers in Utah face a market with more negotiating room than the frenzy of 2020–2022, but affordability pressures remain. The following tactics help balance price sensitivity and long-term objectives:

- Lock in or float strategically — Mortgage-rate movement is one of the largest variables in affordability. Consider rate-lock strategies if a particular property fits long-term needs. Use shorter-lock windows with float-down options where available to avoid excessive locking costs. Alternatively, Salt Lake City cash home buyers bypass financing hurdles entirely, offering certainty without rate volatility.

- Compare neighborhood-level trends — Focus on micro-markets rather than statewide headlines. Use local market reports to find areas with steady employment and limited new supply. For example, Salt Lake City core neighborhoods show different dynamics than outer-ring suburbs.

- Consider alternative product types — Condominiums and townhomes can provide lower entry costs. Explore programs like VA loans and first-time buyer grants when eligible; Utah-specific guides can clarify program details.

- Plan for higher payments initially — Many homeowners will not refinance quickly. Buyers should evaluate cash flow stress tests at conservative interest-rate assumptions.

For first-time buyers in Utah, step-by-step guidance and grant programs can materially improve outcomes. Resources that explain the Utah first-time homebuyer process and local financing programs can be especially useful.

What this means for Utah sellers

Sellers in Utah should adapt expectations to a more measured market. Price discipline, presentation, and marketing now matter more than automatic upward price momentum.

- Price competitively — Homes listed at realistic prices sell faster and often capture stronger final offers. Overpricing increases the risk of extended days on market and subsequent price cuts.

- Invest in targeted improvements — Curb appeal and key interior upgrades can differentiate listings. Prioritize projects with proven resale impact in Utah climates, such as insulation improvements and durable exterior finishes.

- Use staging and professional photography — Presentation matters in slow markets. Staging and strong visuals increase buyer interest and perceived value.

- Explore seller financing or incentives — Creative structures like seller carry-back or temporary rate buydowns can bridge affordability gaps for qualified buyers.

Guidance on preparing a home for sale and proven staging techniques is widely available and can shorten time on market while preserving price. Sellers considering a fast sale should review strategies proven to speed transactions without sacrificing value.

More Properties You Might Like

2098 E GOOSE RANCH RD, Vernal, UT

$103,000

Square feet: 274,864 sqft

2148 E GOOSE RANCH RD, Vernal, UT

$116,000

Square feet: 309,276 sqft

6668 S 3200 W, Spanish Fork, UT

$2,074,000

Bedrooms: 3 Bathrooms: 3 Square feet: 2,560 sqft

What investors should watch in Utah

Investors must separate transient imbalances from structural opportunities. Rental demand in Utah remains strong in many counties due to population growth and limited affordable ownership options. That supports buy-and-hold strategies in areas with strong employment and rental market fundamentals.

- New-construction watchlist — Monitor supply pipelines. Overbuilding in specific corridors may compress rents and appreciation for a period, especially if builders heavily discount to move product.

- Focus on cash flow and cap rates — In a market with potential price stagnation, prioritize properties that generate positive cash flow rather than speculative appreciation.

- Use 1031 exchanges where appropriate — Investors looking to reposition portfolios can defer capital gains using exchange strategies, but execution complexity requires careful planning.

Utah’s growth story remains intact in many metros, but investors should emphasize fundamentals: employment stability, tenant demand, and downside protection through conservative financing.

Neighborhood selection: how to choose in 2026

Selecting the right neighborhood in Utah requires combining data with local knowledge. Consider the following checklist:

- Employment accessibility — Proximity to growing job centers reduces vacancy risk and supports price resilience.

- Supply constraints — Areas with limited developable land or strict growth boundaries tend to outperform when demand rebounds.

- Demographic fit — Neighborhoods with younger home-forming cohorts often sustain steady demand.

- Local amenities — Schools, transit, and outdoor access continue to matter for both owner-occupiers and renters.

Local market monitoring and monthly reports can help identify neighborhood-level shifts before statewide metrics move.

Practical checklist for Utah homebuyers and sellers this year

- Buyers: get preapproved, assess payment capacity at conservative rates, prioritize neighborhoods with job growth, and compare new-construction incentives versus resale value.

- Sellers: price to market, invest selectively in staging and high-ROI repairs, and be prepared to negotiate concessions like closing credits rather than steep price cuts.

- Investors: maintain conservative leverage, stress-test rental income for vacancy and rate increases, and pursue areas with long-term demand drivers.

Where to find more Utah-specific resources

Comprehensive local research and market reports help translate national signals into Utah action plans. For deeper analysis on how shifting buyer-seller balances are playing out across the state, consult resources that track Utah buyer's market indicators and monthly market reports for specific regions. Practical how-to guides exist for securing mortgages in Utah, preparing homes for sale, and leveraging new construction opportunities.

Additional Utah resources include pages that explore the changing buyer-seller dynamics in Utah markets, explain how interest rates influence local markets such as St. George, and offer tactical advice for sellers seeking faster sales and stronger outcomes. For residents seeking a centralized hub of Utah listings and local teams, visit https://bestutahrealestate.com

Local scenarios: three likely outcomes for Utah in 2026

Three plausible scenarios capture the range of outcomes for Utah markets in 2026:

- Stagnation with pockets of correction — Most likely. Median prices hold roughly flat statewide while overheated pockets retrace gains. Inventory rises modestly and days on market lengthen.

- Soft landing driven by mild economic slowdown — Mortgage rates decline slightly because growth cools; affordability remains limited, so demand recovers slowly while prices dip modestly in sensitive neighborhoods.

- Severe stress only if credit or employment shocks occur — Unlikely without a systemic financial malfunction or massive job losses. Under this scenario, distress would appear first in areas with high leverage and speculative new construction.

Bottom line: prepare, don’t predict

Utah participants should prepare for a period of greater market nuance. Rather than waiting for a single nationwide drop, buyers, sellers, and investors should evaluate micro-market conditions, secure appropriate financing structures, and calibrate expectations. Stagnation allows incomes and savings to catch up, which can restore affordability without dramatic price collapses. For those who must transact, rigorous local data, conservative assumptions, and flexible negotiation tactics will produce better outcomes than attempting to time a non-existent national crash.

Frequently Asked Questions

Are home prices likely to drop sharply across Utah in 2026?

A sharp statewide drop is unlikely without a systemic credit event or large-scale job losses. More probable outcomes include price stagnation and localized corrections in overheated submarkets. Areas with heavy new-construction inventory or that experienced outsized gains during 2020 to 2022 are most susceptible to meaningful declines.

Which Utah cities are most at risk for price corrections?

Markets that recorded rapid appreciation and saw large volumes of new construction are most at risk. Consumers and investors should monitor inventory builds, days on market, and the frequency of price reductions. Local market reports and monthly updates provide early warning signs tailored to each city.

Should buyers wait for lower prices or act now?

Timing the market is difficult. Buyers who need housing should focus on affordability-targeted strategies: secure preapproval, lock reasonable rates when a suitable property appears, and prioritize neighborhoods with stable job fundamentals. For buyers with flexibility, watching inventory trends for a few months can reveal whether a submarket is moving into a buyer's advantage.

What can sellers do to avoid long listings and price cuts?

Price competitively from the start, invest in impactful improvements, stage professionally, and use targeted marketing. Sellers should prioritize projects that address buyer pain points in Utah's climate--insulation, exterior durability, and curb appeal. Creative incentives, such as rate buydowns or closing cost contributions, can bridge affordability gaps without slashing list price.

Are investment properties still a good play in Utah?

Long-term fundamentals in many Utah metros--population growth, constrained supply in desirable areas, and strong rental demand--support investment strategies that emphasize cash flow and prudent leverage. Avoid markets with oversupply of new units unless a clear path to positive cash flow exists.

Where can residents find Utah market reports and mortgage guidance?

Local market reports, guides on mortgage qualification in Utah, and monthly regional updates offer actionable context. Specific resources explore buyer's market indicators and how interest rate changes impact local areas such as St. George. These guides provide tactical advice for navigating the shifting landscape.