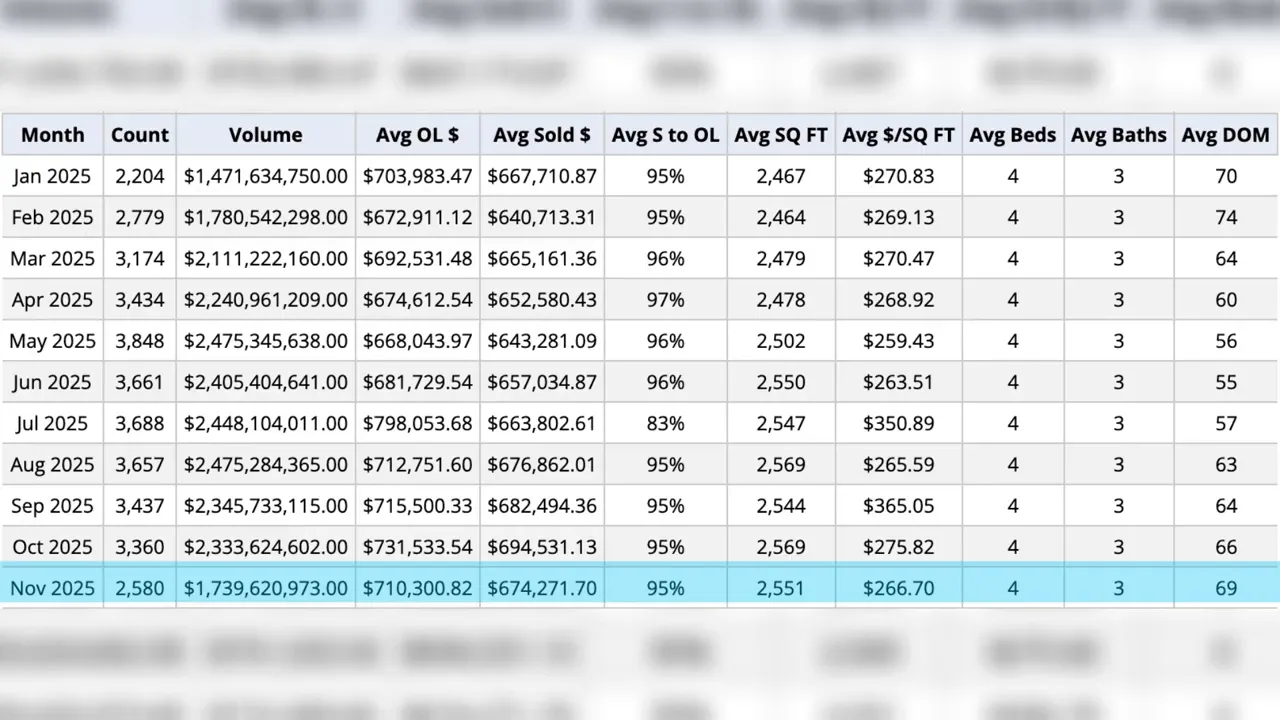

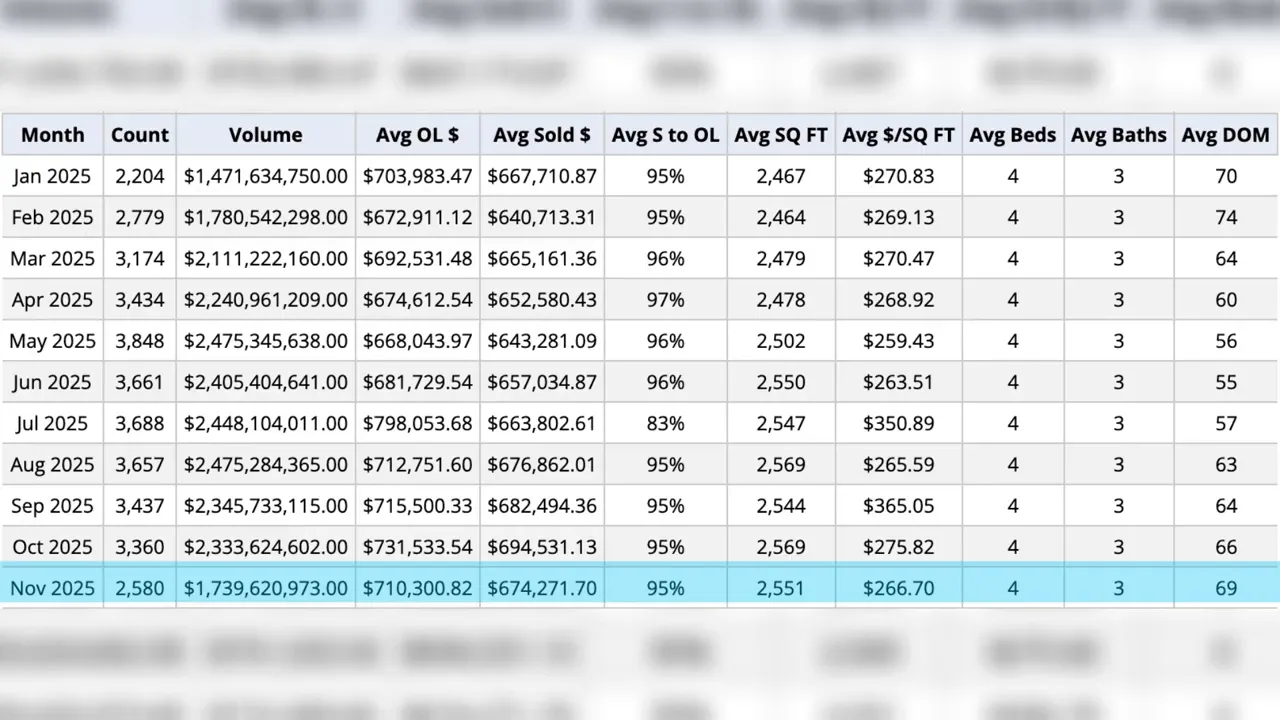

November 2025 delivered a mixed set of signals for Utah real estate: fewer homes closed than the prior November but a substantially higher average sales price. Sales volume in November landed just under 2,600 transactions statewide, while the average sales price hovered near $675,000. These numbers sit inside a 2025 pattern that shows relatively steady monthly activity with occasional dips and spikes in price. Understanding how sales volume, seasonality, and interest rates interact provides actionable insight for buyers, sellers, and investors considering moves in early 2026.

November snapshot: sales volume and prices

November closed with nearly 2,600 recorded sales, one of only three months in 2025 with fewer than 3,000 transactions. January posted the year’s low at about 2,200 sales, and February recorded just under 2,800. Monthly totals demonstrate that the market has not returned to the ultra-high volumes seen during the 2020 surge, yet activity remains meaningful and consistent.

Prices moved up and down through the year. October reached the year-to-date high with an average sales price approaching $695,000, then eased back into the high six-hundreds by November. That short-term pullback is consistent with historic November seasonality when prices often soften slightly before year-end, but year-over-year comparison tells a different story.

Year-over-year perspective: sharper price gains despite lower sales

Explore Utah Real Estate

83 W 850 S, Centerville, UT

$815,000

Bedrooms: 5 Bathrooms: 3 Square feet: 3,999 sqft

653 E RYEGRASS DR #305, Eagle Mountain, UT

$387,900

Bedrooms: 3 Bathrooms: 3 Square feet: 1,985 sqft

2031 N LAVA ROCK CIR #107, St George, UT

$4,185,000

Bedrooms: 4 Bathrooms: 5 Square feet: 5,404 sqft

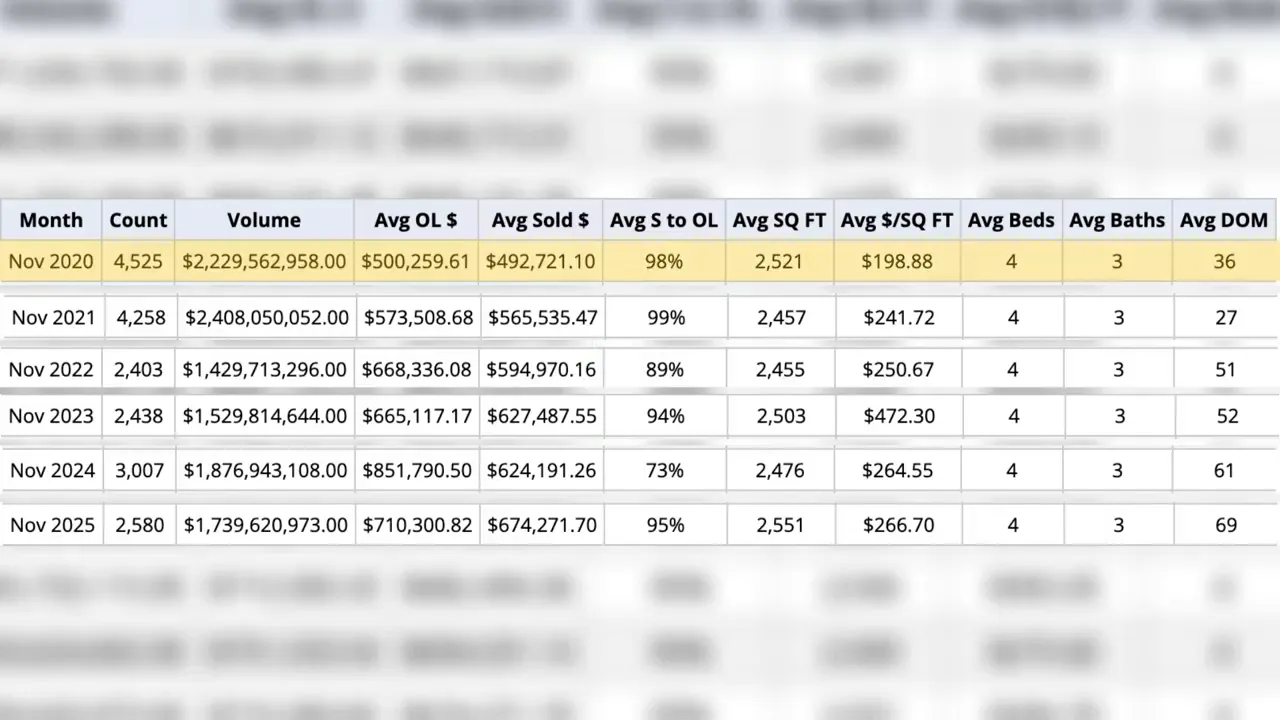

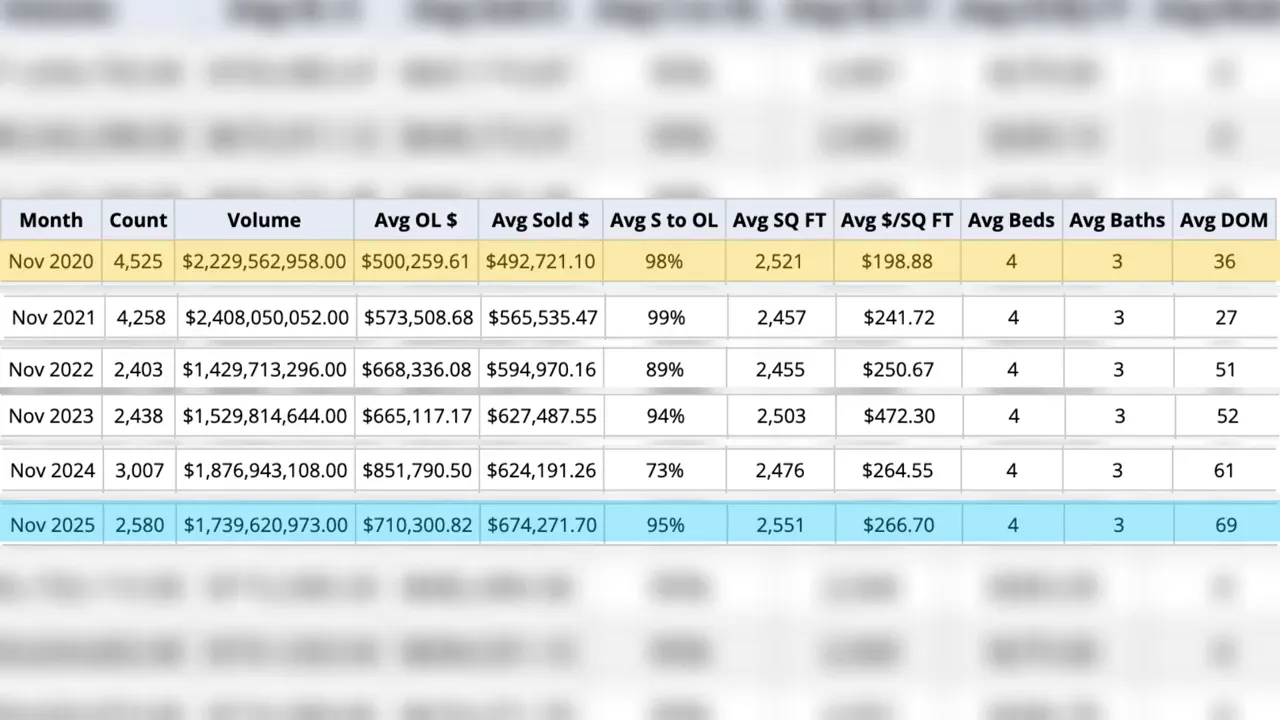

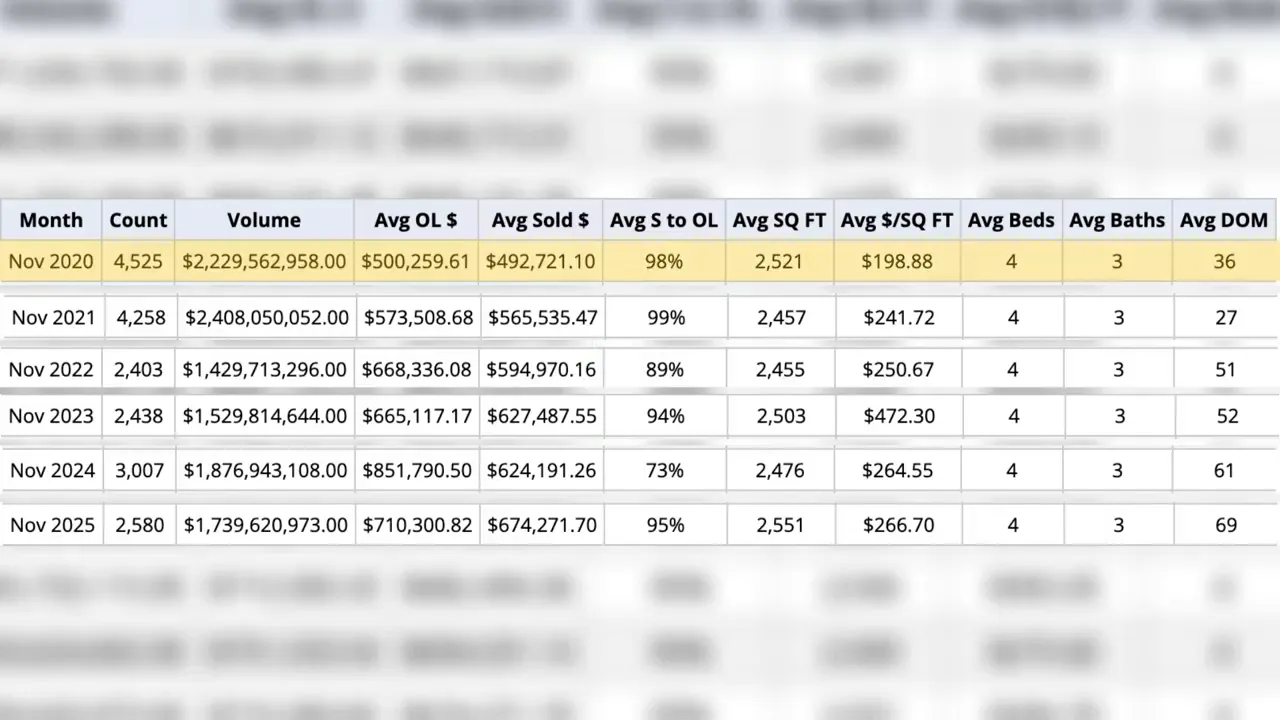

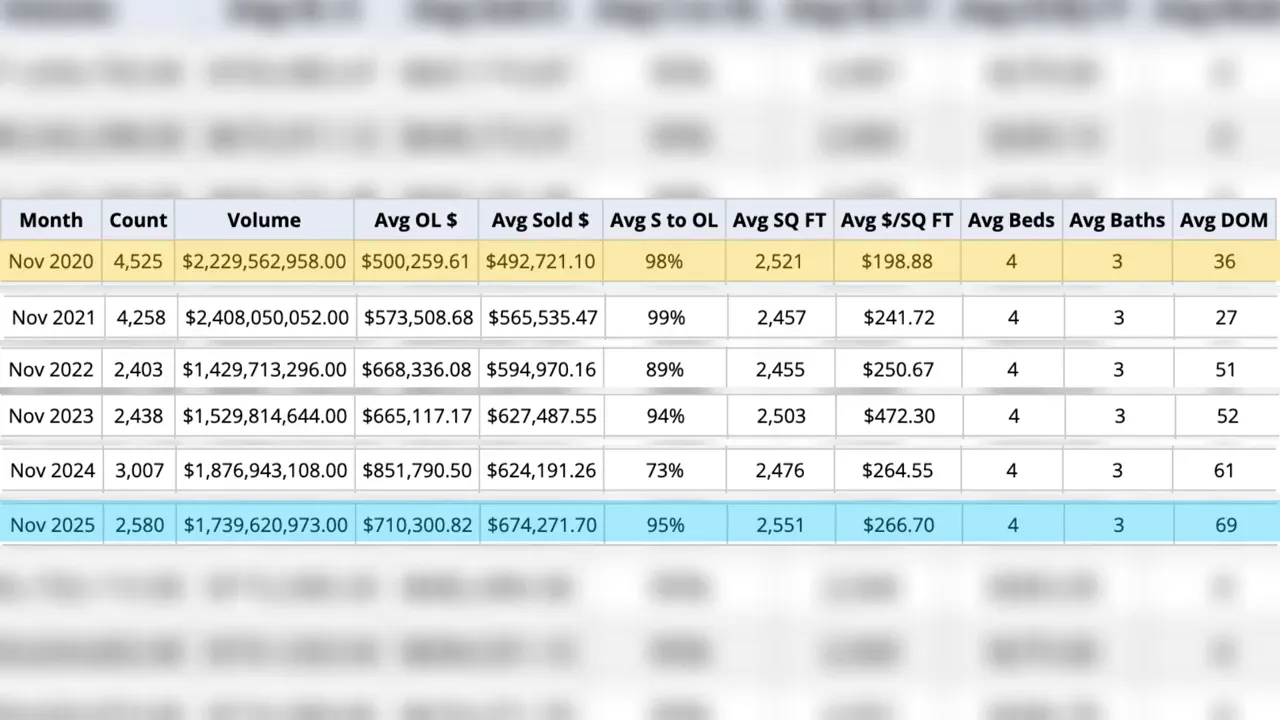

Comparing November 2025 to November 2024 shows a clear divergence between volume and value. November 2024 saw more than 3,000 closings, while November 2025 recorded under 2,600. Despite the lower sales count in 2025, the average sales price increased from about $624,000 in November 2024 to roughly $675,000 in November 2025 — a jump approaching $50,000 in one year. That continued appreciation underlines a fundamental theme: inventory constraints and persistent demand are keeping upward pressure on prices even in months of lower activity.

Longer-term trend: November, 2020 through 2025

Looking at five years of November data provides helpful context. November 2020 marked the beginning of the pandemic-era boom with over 4,500 closings and an average sales price just under $493,000. Fast forward to November 2025 and the average sits near $675,000. That long-term climb confirms that, despite short-term fluctuations and occasional soft months, Utah home values have trended upward over several years.

Interest rates, buying power, and spring outlook

Interest rates have moderated from their summer peaks. While the days of mid-2 and low-3 percent mortgages are unlikely to return, recent quotes in the mid-5 percent range have meaningful effects on affordability. A borrower quoted a 5.675% rate gains buying power relative to a rate above 6 percent from a few months prior. Even modest rate relief can translate into qualification for a higher-priced home for first-time buyers or those stretching to purchase a larger property.

Spring tends to bring greater buyer activity. If rates continue to decline, more buyers will re-enter the market, which could lift competition and push average sales prices upward again. That dynamic means sellers who prepare properly may capture premium pricing in the coming selling season, while buyers should track both rates and local inventory closely to time offers effectively.

Practical guidance for buyers, sellers, and investors

Buyers should prioritize pre-approval and realistic budget planning. With prices higher than recent years, securing a competitive mortgage scenario and understanding total monthly payments will ensure offers remain credible. First-time buyers can also explore available grant programs and eligibility resources to stretch purchasing power and reduce upfront costs; resources on first-time buyer steps and grant options can be useful to review before submitting offers.

More Properties You Might Like

2098 E GOOSE RANCH RD, Vernal, UT

$103,000

Square feet: 274,864 sqft

2148 E GOOSE RANCH RD, Vernal, UT

$116,000

Square feet: 309,276 sqft

6668 S 3200 W, Spanish Fork, UT

$2,074,000

Bedrooms: 3 Bathrooms: 3 Square feet: 2,560 sqft

Sellers benefit from staging, targeted pricing, and marketing that emphasize local demand drivers. With inventory tight relative to long-run averages, many properly prepared homes still garner multiple offers. Sellers should review renovation and staging strategies that deliver visible return at listing, and consider timing that captures peak spring interest when buyer traffic typically increases.

Investors should evaluate longer-term appreciation trends and local rental demand. Utah’s population growth and strong job markets in many metros continue to support both home value appreciation and sustained rental markets. Investors focused on cashflow or value-add projects should align acquisition strategies with realistic renovation budgets and hold-period assumptions.

For further local resources, consult the interest rate analysis specific to St. George and a market-condition primer for spotting the right time to buy:

- https://bestutahrealestate.com/news/how-interest-rates-affect-st-george-real-estate-market

- https://bestutahrealestate.com/news/home-buying-101-spotting-the-right-market-conditions-to-buy

The main site with statewide listings and tools is available at https://bestutahrealestate.com for those who want an up-to-date search portal and market pages.

Key takeaways

- Sales volume in November 2025 dipped below November 2024, but remained broadly consistent with 2025 monthly activity.

- Average sales price rose year over year by a significant margin, illustrating longer-term upward pressure on values.

- Interest rate relief into the mid-5 percent range improves buying power and could stimulate a busier spring market.

- Seasonality matters — November often softens, but spring historically brings more competition and higher pricing.

Further reading and tools

Explore detailed strategies for selling and staging homes, negotiation best practices for cash offers, and tips on maximizing return for investors in Utah. A selection of practical guides and local market reports can help property owners and buyers prepare for the 2026 market cycle.

Frequently Asked Questions

Are Utah home prices still rising despite fewer sales?

Yes. Even when monthly sales volume dips, Utah has shown continued year-over-year growth in average sales price. Longer-term trends, limited inventory, and steady demand have kept upward pressure on prices across several years.

How do changing interest rates affect buyer affordability?

Mortgage rate changes alter monthly payments and qualification thresholds. A decline from just above 6 percent to the mid-5 percent range can increase a buyer's purchasing power enough to qualify for a higher-priced home. Buyers should get pre-approved to understand true affordability under current rates.

Is Utah a buyer's market or a seller's market right now?

Market conditions vary by price tier and neighborhood. Some indicators point toward more buyer leverage than during the peak frenzy, but statewide price growth and limited quality inventory still favor sellers in many segments. Local market analysis by neighborhood provides the best guidance for a specific transaction.

When is the best time to list a home for top value?

Spring typically generates the most buyer activity and competition, which often results in higher sale prices and faster closings. Proper pre-listing preparation, competitive pricing, and timing the market for peak demand can improve outcomes regardless of month.