Introduction

The U.S. housing market continues to evolve, and current signals point to higher inventory, shifting local dynamics, and a gradual rise in distressed sales—though nowhere near the levels seen during the Great Recession. This analysis synthesizes recent national inventory data, metro-level shifts, and foreclosure trends, and then translates what those trends mean for Utah buyers, sellers, and investors. The goal is to provide actionable, data-driven guidance tailored to Utah's market context.

Key Takeaways

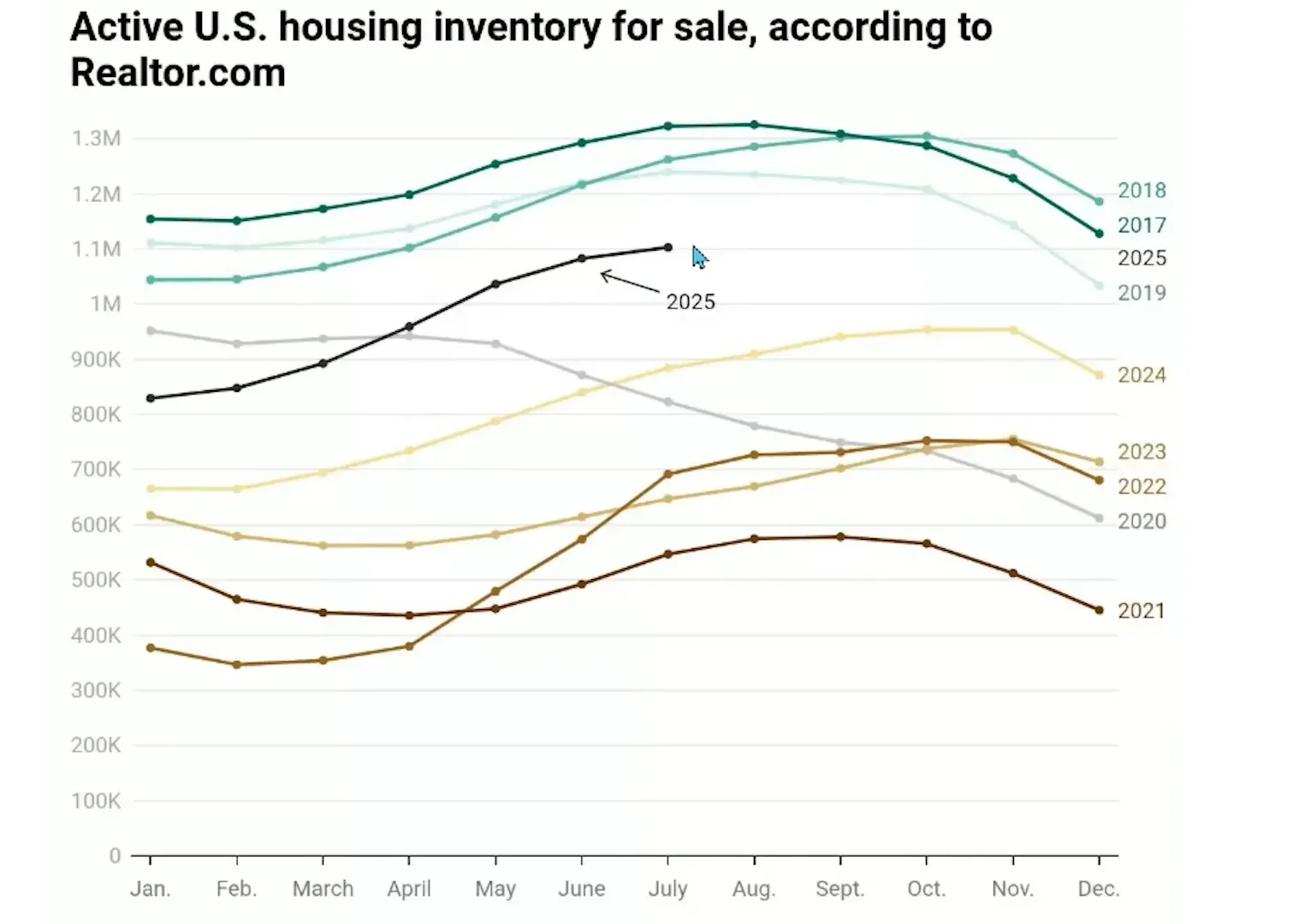

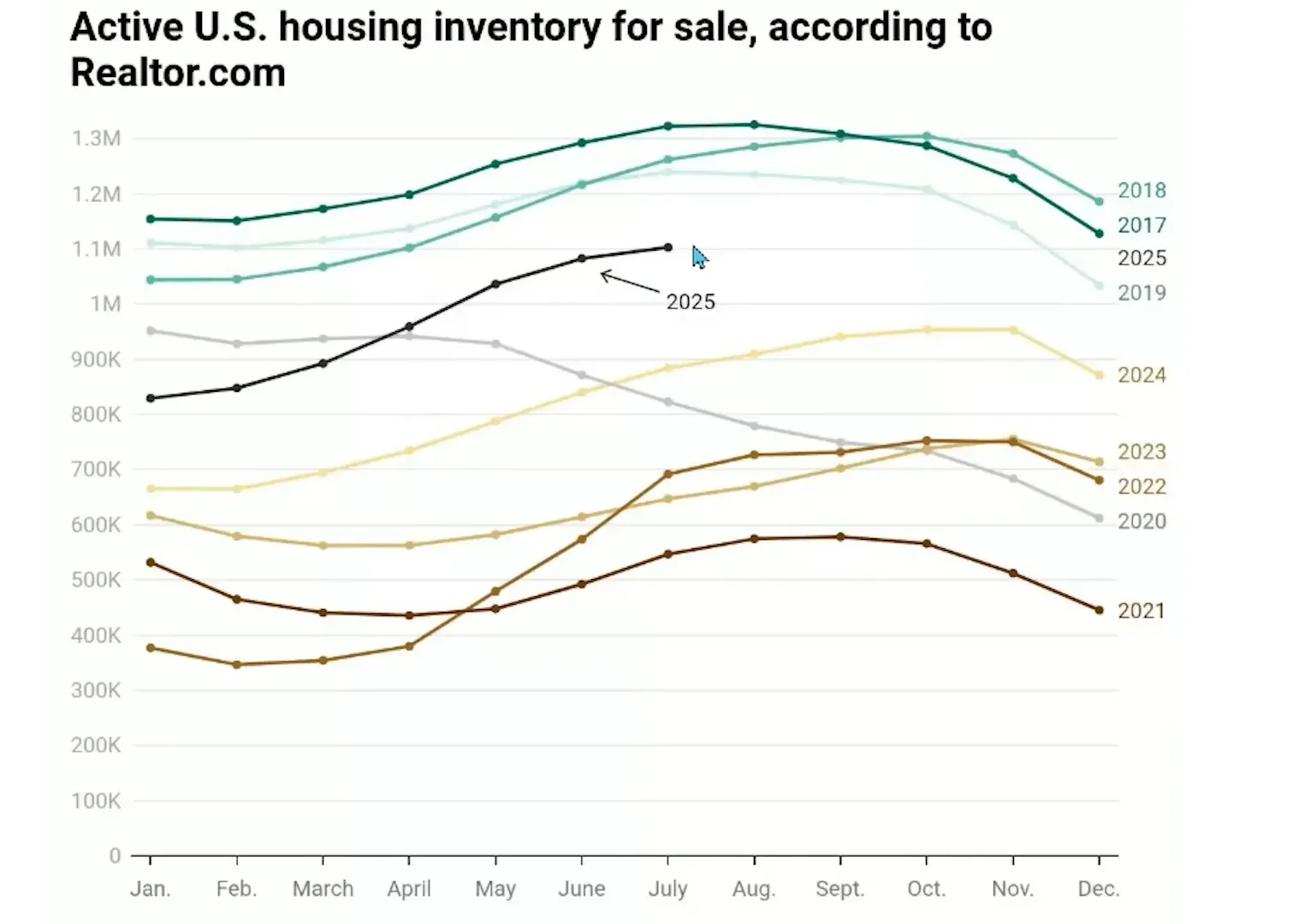

- U.S. inventory has risen year-over-year by roughly 25% but remains about 11% below pre-pandemic (2019) levels.

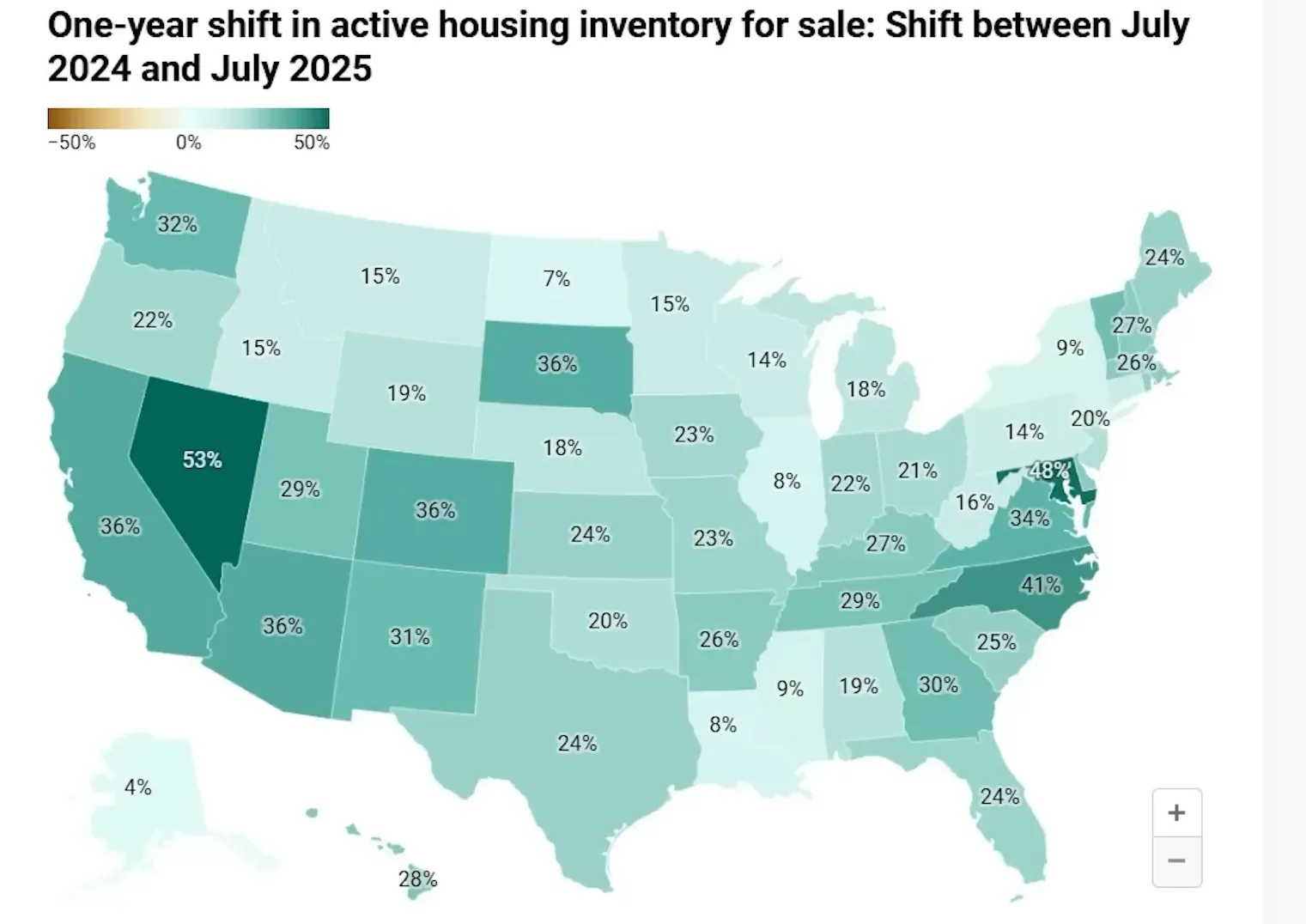

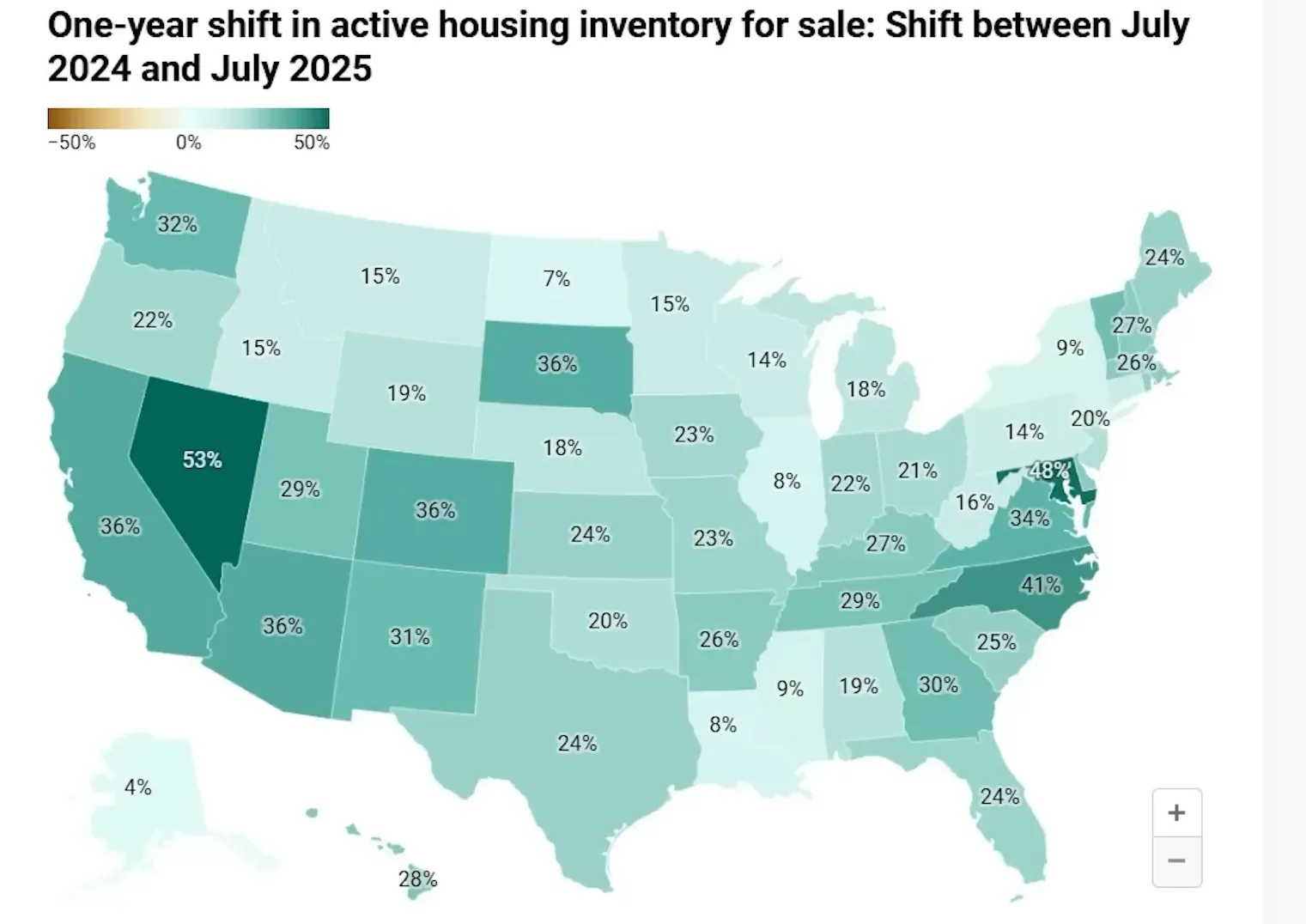

- Twelve states now report inventory levels above 2019, while many others are still below—creating a patchwork of market conditions by state and metro.

- Several fast-growing metros have far more supply than in 2019 (Austin +64%, Denver +48%, San Antonio +44%), while some regions like the greater Sacramento area are slightly tighter than 2019 levels.

- Foreclosures are increasing gradually since moratoria ended, but quarterly volumes are far below 2009 peaks; current quarterly foreclosure counts are roughly 60,000 versus nearly 600,000 at the 2009 high.

National Inventory Trends: What the Numbers Say

Inventory has been climbing on a year-over-year basis, driven by changing buyer demand, mortgage rate pressures, and a slow return of seller confidence. According to aggregated Realtor.com-based figures, total active listings are hovering around 1.1 million—higher than any post-COVID month but below the historical average of about 1.25 million for the same period in 2019. This partial recovery in supply has put downward pressure on price growth in many markets and led to outright price declines in some overheated metros.

Explore Utah Real Estate

83 W 850 S, Centerville, UT

$815,000

Bedrooms: 5 Bathrooms: 3 Square feet: 3,999 sqft

653 E RYEGRASS DR #305, Eagle Mountain, UT

$387,900

Bedrooms: 3 Bathrooms: 3 Square feet: 1,985 sqft

2031 N LAVA ROCK CIR #107, St George, UT

$4,185,000

Bedrooms: 4 Bathrooms: 5 Square feet: 5,404 sqft

State and Metro Variations

The inventory recovery is uneven. Twelve states now exceed their 2019 inventory levels, and growth is strongest in Sun Belt and Mountain West markets—examples include Texas, Florida, Arizona, Colorado, and several Pacific Northwest states. Utah's inventory shows a notable increase compared to 2019 levels (roughly +23%), aligning with other high-demand Western states that have seen more homes come to market than during pre-pandemic times.

What This Means for Utah

Utah sits at an interesting intersection of higher listings and continued demand. An increase in inventory compared to 2019 presents more options for buyers in many Utah metros, while still supporting healthy appreciation in neighborhoods with constrained supply or strong job growth. For sellers, increased listings mean pricing strategy and presentation matter more—homes need to stand out. For investors, select Utah cities continue to show long-term fundamentals—population growth, strong employment pipelines, and lifestyle amenities that support demand.

For Utah-focused resources and listings, refer to https://bestutahrealestate.com for local market portals updated frequently.

Practical Implications by Buyer Type

- First-time buyers: More inventory improves the chance of finding a home without aggressive bidding wars; however, affordability remains sensitive to rates.

- Move-up buyers: Wider selection helps with trade-up options, but timing matters—consider loan rate locks and contingency planning.

- Investors: Look for neighborhoods with persistent demand and limited new supply; higher metro-level inventory can create opportunities to negotiate.

MLS and Offer Activity: How Competitive Is the Market?

Local multiple listing services provide an unfiltered view into market competitiveness by tracking the number of offers received per listing. In many markets that have cooled from the extremes of 2022, listings are commonly receiving one or two offers rather than the six-plus offers that were typical during the pandemic-fueled frenzy. For example, in one large metro, pending inventory counts showed roughly 891 pending sales with the majority receiving only one or two offers and only a handful (eight properties) receiving more than ten bids—an unmistakable contrast to 2022 when multiple-showing appointment lists and dozens of offers were common.

More Properties You Might Like

2098 E GOOSE RANCH RD, Vernal, UT

$103,000

Square feet: 274,864 sqft

2148 E GOOSE RANCH RD, Vernal, UT

$116,000

Square feet: 309,276 sqft

6668 S 3200 W, Spanish Fork, UT

$2,074,000

Bedrooms: 3 Bathrooms: 3 Square feet: 2,560 sqft

Foreclosures: Rising, but Not a Crisis

Foreclosures have ticked up steadily since the moratoria ended, and a notable bump occurred when the VA foreclosure moratorium expired, temporarily raising quarterly counts. Despite the increase, foreclosure volumes remain moderate compared to past recessions. Recent quarterly totals of roughly 60,000 are well below the Great Recession-era peaks when some quarters approached 600,000 foreclosures. The current trend is one of gradual normalization rather than systemic collapse.

“Are foreclosures spiking or not?”—this remains the central question for many. The answer from the data is nuanced: foreclosures are increasing from unusually low pandemic-era levels, but they are far below historical crisis peaks.

Step-by-Step Guide: How Utah Buyers Should Approach the Market

- Get pre-approved by a lender and understand the true borrowing cost—lock in realistic monthly payment expectations given current rates.

- Define a target neighborhood list that balances price, commute, schools, and resale potential.

- Use local MLS alerts and work with a knowledgeable agent to see new listings within the first 24–48 hours of coming to market.

- Be prepared to act quickly on well-priced, well-presented homes; in less competitive listings, allow time for inspection contingencies and negotiation.

- For investors, perform a cash-flow analysis that includes vacancy reserves and maintenance in addition to mortgage and taxes; consider long-term appreciation drivers in Utah metros.

Tips for Utah Sellers

- Stage and price homes competitively based on recent comps and current days-on-market metrics.

- Prioritize minor updates that deliver strong visual returns (paint, landscaping, decluttering).

- Choose listing windows strategically—inventory can be seasonal, and standout listings perform better when supply is tighter.

Data Sources and Further Reading

Primary data referenced here includes aggregated inventory reports and foreclosure charts compiled from market analytics platforms and central bank data. For national demographic and housing trend context, consult authoritative sources such as census.gov and nar.realtor. Local MLS feeds remain the most immediate source of market micro-trends and offer activity.

Conclusion

The housing market has shifted from the intense supply constraints and bidding wars of early 2022 toward a more balanced—even if still imperfect—landscape. Inventory growth has provided buyers with more options, while foreclosure volumes have inched upward without approaching historical crisis levels. For Utah, the combination of higher listings in many areas and continued population and job growth suggests that opportunities exist for buyers, sellers, and investors who prepare strategically and act on local market intelligence.

Frequently Asked Questions

Is the housing market crashing?

Current indicators do not point to a crash. Inventory has increased, which softens price growth in some markets, and foreclosures are rising from pandemic lows but remain well below the Great Recession-era peaks. Market conditions vary sharply by state and metro.

What does higher inventory mean for Utah home prices?

Higher inventory generally moderates price increases by giving buyers more choices, but in fast-growing Utah neighborhoods with supply constraints and strong demand, price resilience or continued growth is still possible. Local micro-markets and new construction activity will determine outcomes.

Are foreclosures a major risk to Utah homeowners?

At present, foreclosures are trending upward slowly but are not at crisis levels. Homeowners facing financial stress should explore loan modification, forbearance programs, or local counseling resources to avoid foreclosure. Investors should monitor foreclosure pipelines for potential opportunities, but caution is advised.

How should a buyer in Utah prepare given current trends?

Buyers should secure pre-approval, define clear neighborhood priorities, monitor MLS listings closely, and be prepared to negotiate. Increased inventory gives buyers more leverage in some situations, but strong properties in desirable locations still move quickly.