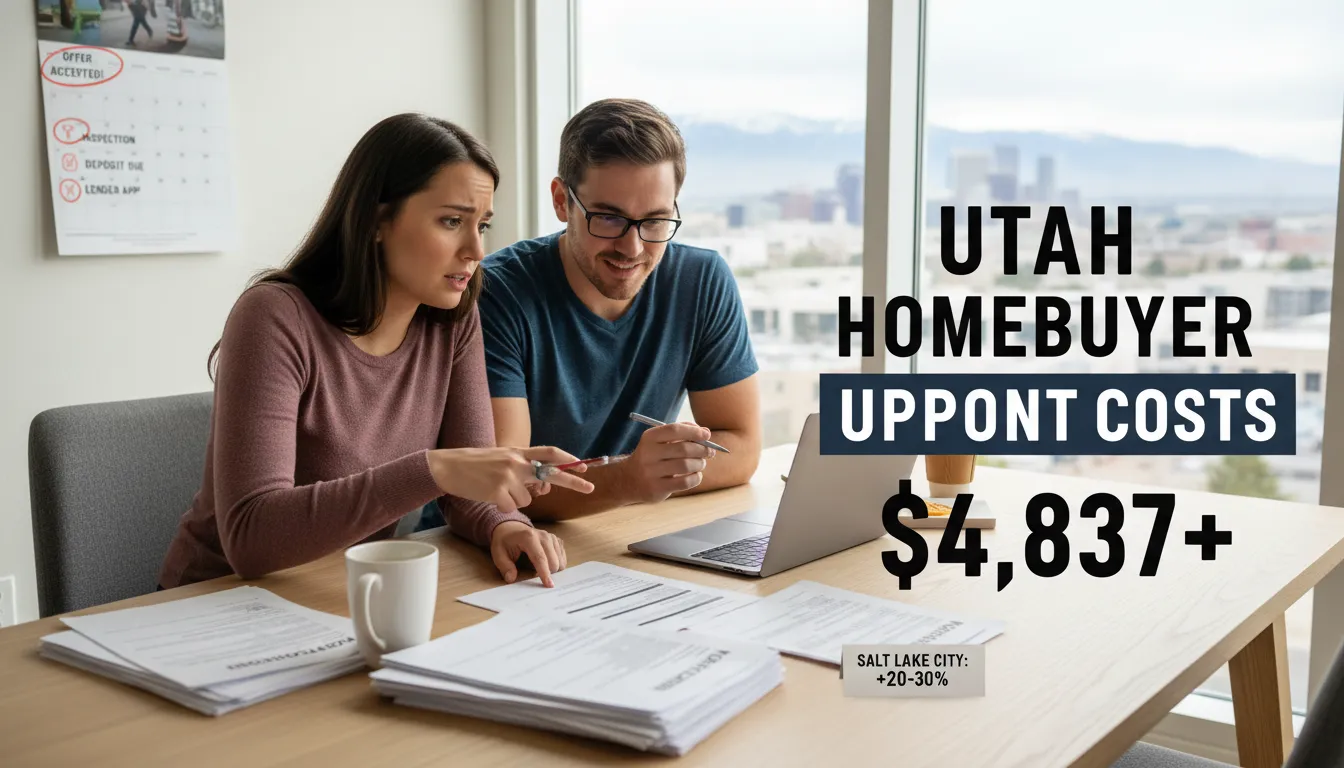

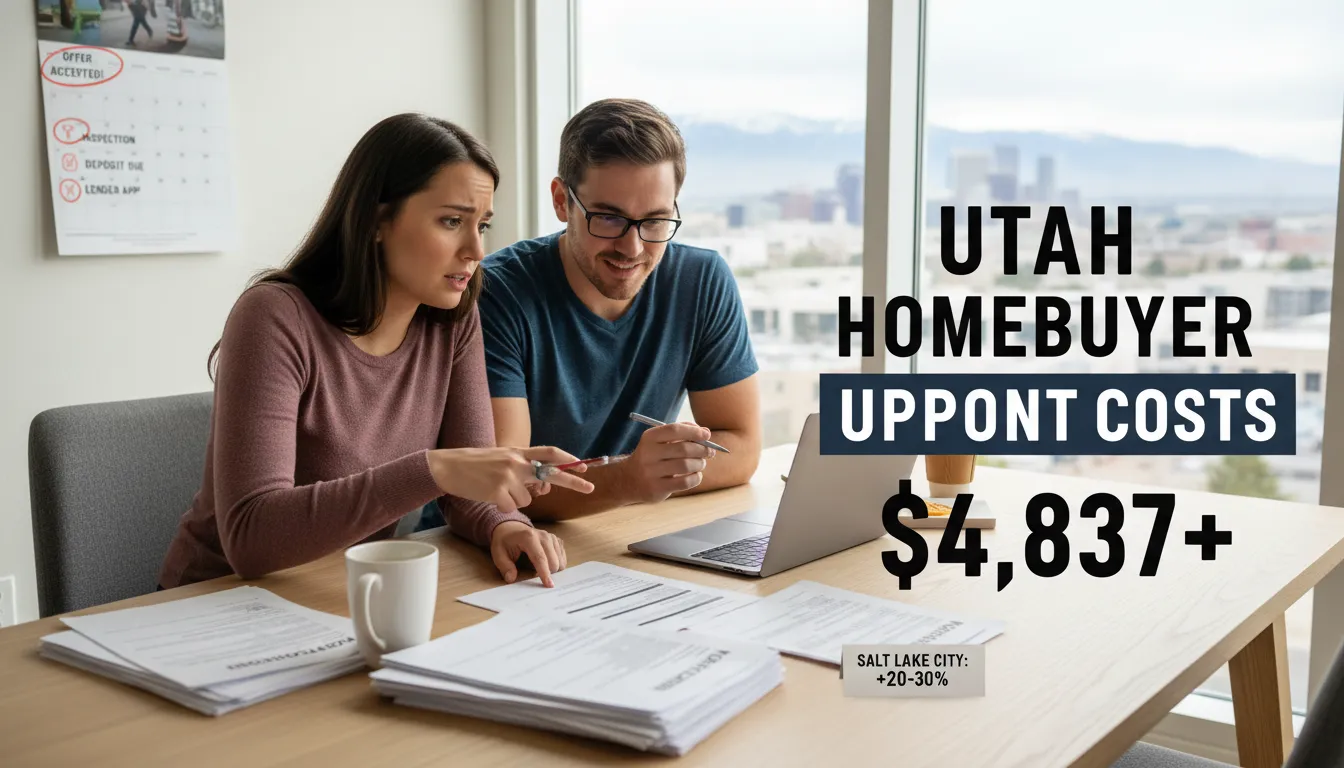

In Utah, homebuying has a well-marked trail until the terrain suddenly changes. One minute, your offer is accepted, and spirits are high. Next, a series of required payments starts rolling in before you ever reach closing day. That’s when you realize the trailhead was only the beginning.

For many buyers, especially first-time homebuyers in Utah, the challenge is not affordability over 30 years. It is managing several upfront homebuyer costs that arrive close together, often within weeks. Understanding these expenses early helps buyers avoid stress and stay focused on the finish line.

What Happens Financially After Your Offer Is Accepted

Things move quickly once the seller accepts your offer. Inspections, deposits, and lender steps follow a short timeline. Utah homebuyers pay about $4,837 in upfront costs after acceptance, which is roughly 2-5% of the purchase price.

In competitive markets like Salt Lake City, those costs can rise 20-30%. It’s because buyers often plan to add specialized inspections to stay competitive. Note that these expenses are not optional; they are part of keeping the deal alive.

Common Pre-Closing Expenses

- Inspection and testing fees paid upfront

- Earnest money deposits due within days

- Appraisal costs Utah required by lenders

- Loan-related charges before final approval

Each payment for managing home purchase costs may seem manageable alone. Together, they often land during the same pay cycle.

Understanding Inspection Fees

Home inspection fees Utah vary by size and testing needs. A basic inspection for homes up to 4,000 square feet usually runs $400-$500. Many buyers add radon testing due to local conditions, bringing the average to $475.

Larger homes (up to 7,000 square feet) typically cost between $525 and $625. Sewer scopes, roof checks, or mold inspections can add several hundred dollars more.

Inspection Costs at a Glance

Before negotiations even begin, you have a few expenses, such as:

|

Inspection type

|

Typical cost range

|

|

Standard home (≤4,000 sq ft)

|

$400-$500

|

|

With a radon test

|

~$475

|

|

Large home (4,001-7,000 sq ft)

|

$525-$625

|

|

Add-on tests

|

+$150-$400 each

|

Earnest Money Deposits and Cash Commitment

Earnest money shows sellers you are serious. Utah earnest money deposit is 1-3% of the purchase price. On a $450,000 home, that equals $4,500-$13,500 paid shortly after acceptance.

In competitive Salt Lake County areas, deposits of $5,000-$15,000 or more are common. Although earnest money is credited toward closing, it must be available immediately. For buyers juggling inspections and appraisals, this timing creates real pressure.

Appraisal Costs

Across Utah, appraisal costs average $675. This amount is lower (between $340 and $435) for most of the single-family homes. On the other hand, multifamily or unique properties may require paying $825.

Because appraisals follow inspections closely, buyers often pay this fee while other costs are still pending. It is a classic pre-closing expense that catches people off guard.

Other Loan-Related Charges

Loan-related charges extend beyond interest rates. Origination fees often range from 1-3% of the loan amount, alongside notary, recording, and processing fees. These costs contribute to the $4,837 average Utah buyers pay after offer acceptance.

Some charges are due upfront, while others appear just before closing. Buyers focused only on monthly payments may underestimate how these fees affect short-term cash flow.

When Timing Creates a Temporary Cash Gap

The real issue is not the total cost but the timing. Inspections, earnest money, appraisals, and loan fees can all fall within the same two to three weeks. Even disciplined savers can feel stretched during this window.

In these situations, some buyers look into UT short term cash support as a temporary bridge when multiple upfront payments hit at once. Used responsibly, it is viewed as a short-term solution to manage timing gaps, not a substitute for long-term affordability planning.

Early Moving Preparation

Moving costs often begin before closing. Buyers may pay an advance payment to movers to secure availability. They might also rent trucks ($200 per day) and purchase packing supplies ($300-$800) early.

Altogether, early moving preparation can add $500-$2,000 in unbudgeted expenses. While not unique to Utah, these costs contribute to the 10-15% surprise expense range many buyers experience near closing.

Practical Ways Buyers Reduce Upfront Strain

Small planning adjustments often make the biggest difference. A few things that you can do are:

- Keep a separate pre-closing buffer

- Ask for a payment timeline

- Prioritize required inspections

- Avoid optional upgrades when the budget is tight

- Delay nonessential moving expenses until you have keys

Summary of Upfront Homebuyer Costs in Utah

|

Expense category

|

Typical timing

|

Common cost range

|

|

Home inspections & testing

|

Within days of offer acceptance

|

$400-$625+ depending on size and add-ons

|

|

Earnest money deposit

|

1-3 days after acceptance

|

1-3% of purchase price ($4,500-$13,500 on a $450,000 home)

|

|

Appraisal fee

|

After inspections, before final approval

|

$340-$825

|

|

Loan-related charges

|

Throughout underwriting

|

Part of $4,837 buyer average

|

|

Early moving preparation

|

Before closing

|

$500-$2,000

|

Planning Smarter for Buying a Home in Utah

Home is a long-term goal for many buyers. If you plan to buy in Utah, early preparation helps the process feel manageable. For example, knowing when expenses are due reduces last-minute stress. A smart first-time homebuyer Utah also factors in advanced concerns, such as radon risk outlined by the Environmental Protection Agency, when planning inspection budgets. With realistic expectations and careful planning, the process becomes far less overwhelming.