Utah's housing market is currently facing significant challenges as interest rates remain elevated, and no Federal Reserve (Fed) rate cut appears imminent. This situation is shaping the real estate landscape across the state, influencing property inventory, buyer behavior, and market timing strategies. Understanding these dynamics is crucial for buyers, sellers, and investors navigating the Utah housing market in 2024.

Current Interest Rate Environment and Its Impact

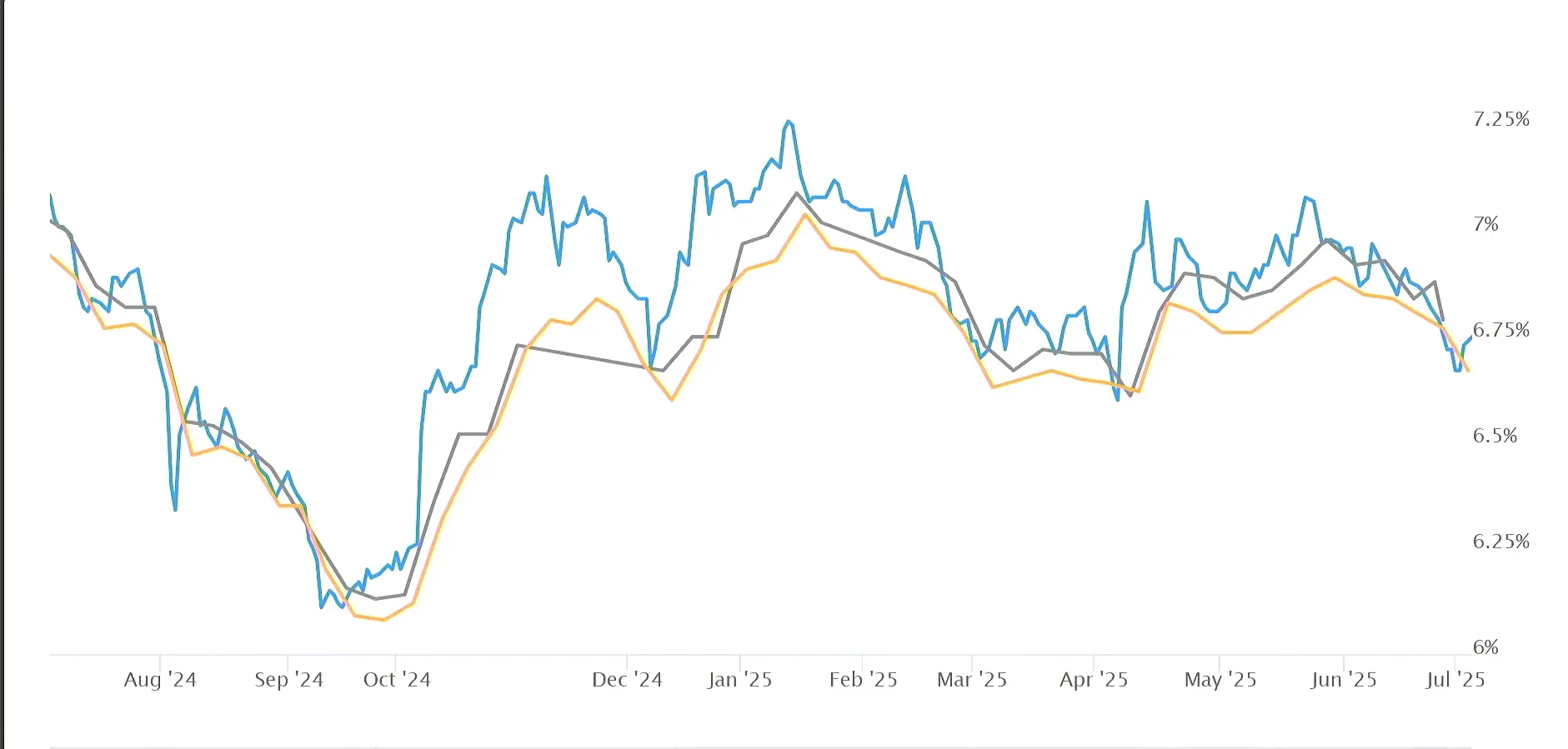

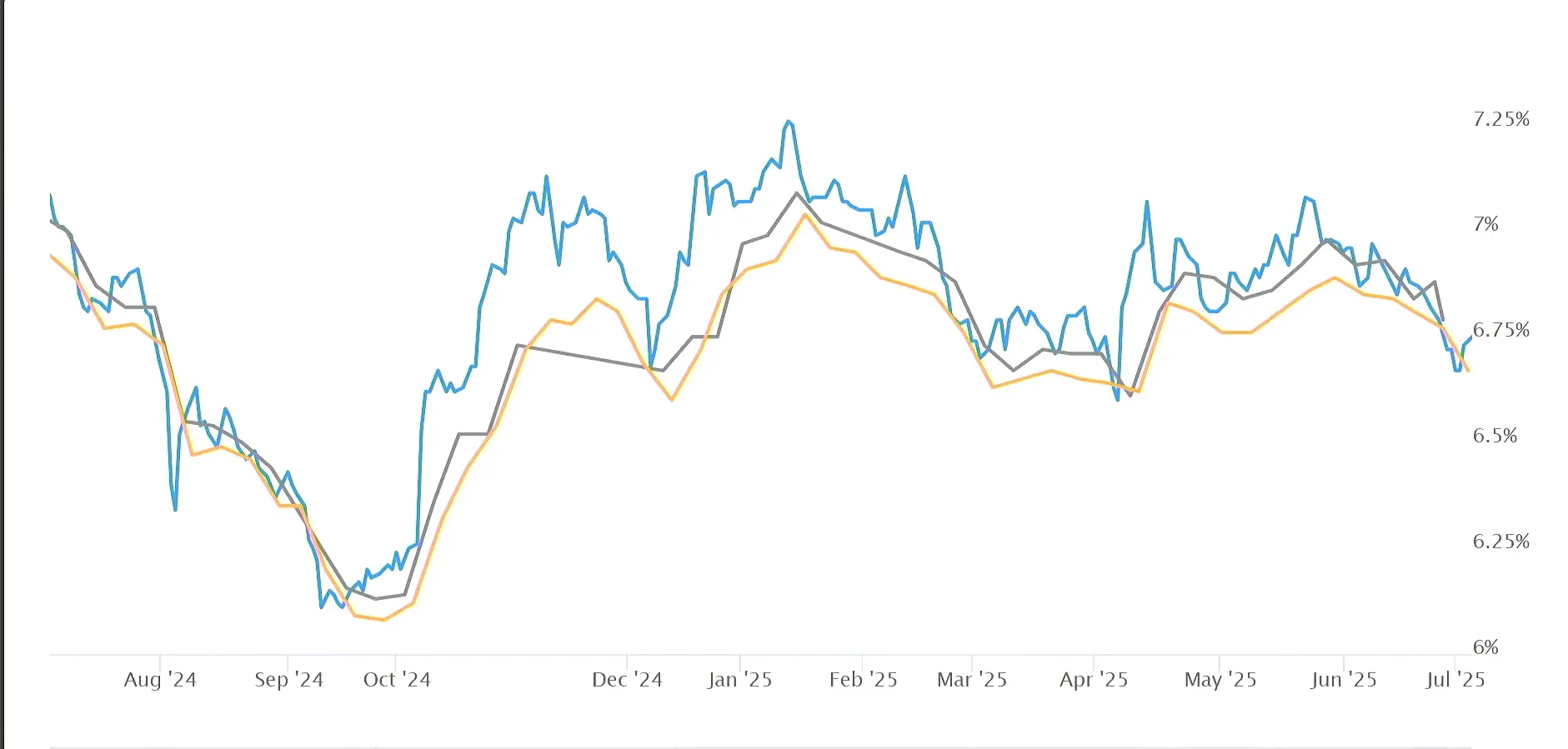

Recent economic data indicates that interest rates will likely stay higher for an extended period. After the release of June's jobs figures, which were stronger than expected, the ten-year Treasury yield experienced a noticeable uptick. This movement is mirrored in the thirty-year fixed mortgage rates, which also reversed a downward trend and began rising again.

This correlation between Treasury yields and mortgage rates is not about the Fed's immediate actions but rather about expectations for the Fed's stance a year from now. If forecasts suggest only one or two rate cuts by July 2026, long-term interest rates will remain elevated. Conversely, more anticipated cuts would pressure these rates downward. Currently, data points toward limited cuts, keeping mortgage rates stubbornly high.

Labor Market Data: Strong June Jobs Report Versus Underlying Concerns

The U.S. economy added 147,000 jobs in June 2025, surpassing expectations, while the unemployment rate dropped to 4.1%. On the surface, this signals a robust labor market. However, past revisions reveal discrepancies; notably, in August 2024, labor market data was adjusted downwards by 818,000 jobs compared to earlier reports. These adjustments highlight the volatility and uncertainty in employment statistics and their influence on economic forecasts.

Private payroll reports like the ADP have consistently fallen below expectations, and much of the job creation has been in government and healthcare sectors. This raises questions about the quality and sustainability of new jobs, which in turn affect consumer confidence and housing demand.

Fed Rate Cut Prospects and Market Timing

Jerome Powell, Chair of the Federal Reserve, confirmed that rate cuts would have occurred if not for tariffs, underscoring the Fed's cautious approach. The next potential Fed rate decision is scheduled for July 30, 2025, but the likelihood of a cut has diminished significantly, with recent market sentiment placing about a 90% chance of no rate cut at that meeting. The subsequent opportunity for a rate cut would be mid-September.

This outlook has direct implications for the Utah housing market. Higher interest rates suppress buyer activity, leading to an accumulation of inventory. Sellers, in particular, are feeling pressure as they await relief that has yet to materialize.

Rising Inventory and Its Effects on the Utah Housing Market

Inventory levels in Utah have risen substantially compared to previous years, with significantly more homes currently active on the market. This trend is expected to continue for several more months, potentially peaking between September and October 2024. The surplus of homes increases competition among sellers and creates opportunities for buyers seeking better deals.

Explore Utah Real Estate

83 W 850 S, Centerville, UT

$815,000

Bedrooms: 5 Bathrooms: 3 Square feet: 3,999 sqft

653 E RYEGRASS DR #305, Eagle Mountain, UT

$387,900

Bedrooms: 3 Bathrooms: 3 Square feet: 1,985 sqft

2031 N LAVA ROCK CIR #107, St George, UT

$4,185,000

Bedrooms: 4 Bathrooms: 5 Square feet: 5,404 sqft

However, the combination of high interest rates and growing inventory means many potential buyers are hesitant to enter the market. The average mortgage interest rate hovering above 7% discourages new purchases, especially for those who would have been enticed by rates trending down toward 6%. This dynamic could further prolong the market slowdown.

Seasonal Factors and Buyer Behavior

As summer progresses and the school year approaches in August, the pace of home sales typically slows. Many families prefer not to move during the school year, and apartment complexes often encourage lease renewals to avoid winter vacancies. These seasonal patterns, coupled with the current interest rate environment, suggest that even if the Fed cuts rates in September or October, the market may not see a significant uptick in activity until later.

Strategic Timing for Buyers in Utah

Timing the Utah housing market in 2025 depends largely on buyer priorities. For those seeking move-in ready homes with high-end finishes like granite or quartz countertops, entering the market between July and September is advisable. This period typically offers the best selection of turnkey properties.

Buyers willing to invest time and effort into renovations or cosmetic updates can find better deals by waiting until September through November. During this window, inventory peaks, and sellers with homes lingering on the market may be more motivated to negotiate.

Patience can pay off, especially as inventory may continue to rise slightly, potentially reaching around 14,000 active listings in July before plateauing. Serious sellers will likely remain on the market, while some homeowners may temporarily withdraw their properties, only to relist them later at potentially higher prices.

Foreclosures and Long-Term Market Outlook

Prospective buyers waiting for a surge in foreclosures or a recession-driven market correction should anticipate delays. Foreclosure moratoriums, especially for FHA loans, continue to be extended, pushing any significant foreclosure activity into 2026 or beyond. Until these protections expire, the market will not operate under typical free-market conditions, limiting distressed property availability.

More Properties You Might Like

2098 E GOOSE RANCH RD, Vernal, UT

$103,000

Square feet: 274,864 sqft

2148 E GOOSE RANCH RD, Vernal, UT

$116,000

Square feet: 309,276 sqft

6668 S 3200 W, Spanish Fork, UT

$2,074,000

Bedrooms: 3 Bathrooms: 3 Square feet: 2,560 sqft

Monitoring Key Indicators: Ten-Year Treasury and Mortgage Rates

Staying informed about the ten-year Treasury yield and thirty-year fixed mortgage rates is essential for understanding market trends. These indicators often signal future Fed actions and influence mortgage costs directly. Additionally, keeping an eye on local inventory levels will help buyers and sellers make timely decisions.

Conclusion: Navigating Utah's Housing Market in a High-Rate Environment

The Utah housing market in 2025 is shaped by a complex interplay of higher interest rates, rising inventory, and cautious buyer behavior. With no Fed rate cut expected in the near term, mortgage rates remain elevated, deterring some buyers but creating opportunities for those ready to act strategically.

Buyers should consider their priorities carefully—whether seeking move-in ready homes or willing to renovate—and time their market entry accordingly. Sellers face challenges from increased competition and must remain realistic about pricing and timing.

For those interested in staying ahead, signing up for localized market updates and monitoring key economic indicators can provide a significant advantage in this evolving landscape.

Related Articles:

Frequently Asked Questions

Will the Federal Reserve cut interest rates soon?

As of mid-2025, the Fed is unlikely to cut rates at the July meeting, with the next potential cut in September. Market consensus currently favors maintaining higher rates for the foreseeable future.

How do higher interest rates affect Utah's housing market?

Higher interest rates lead to increased borrowing costs, reducing buyer affordability and demand. This contributes to rising inventory and slower home sales.

When is the best time to buy a home in Utah in 2025?

For move-in ready homes, July through September offers the best selection. Buyers open to renovation projects may find better deals from September through November as inventory peaks.

Are foreclosures expected to impact the market soon?

Foreclosure activity remains limited due to ongoing moratoriums, with significant impacts unlikely until 2026 or later.

What local resources can help buyers and sellers stay informed?

Monthly market updates focusing on inventory and pricing trends in Utah's key regions, such as the Greater Salt Lake area,

Park City, and

Saint George, provide valuable insights for market participants.