Inheritance is commonly a gift wrapped with the most difficult times. You are mourning the loss of someone you loved and at the same time, you are handling legal procedures, family relationships, and money matters. The home, which is filled with countless memories of your family, turns into a reality that requires your urgent intervention.

Where some inherited properties are just simple assets that improve your financial situation, others become liabilities that cause you to lose money and get stressed. Identifying the reasons for selling your property quickly can save you from the hassle of a long struggle that can last for months or years with a property that brings you no benefit.

The Financial Drain Exceeds the Potential Value

Inherited properties often come with the immediate additional costs that are required as soon as you become the owner. Estate settlements do not stop the payment of property taxes. The house may or may not be insured, in case the house is empty, you have to continue paying the insurance policy. Bills for water, electricity, and gas keep coming. The mortgage, if there is one, will have to be paid on a monthly basis whether you are able or willing to do so. These holding costs are real money that goes out of your pocket, and you have not yet even thought about what you will do with the property.

On top of that, deferred maintenance issues increase the costs of these basic ones significantly. The attic will be affected with the water coming from the roof that your dead relative was delaying to replace. The HVAC system that was struggling in its last seasons is now broken in one of the hottest/coldest seasons, and the house is exposed to temperature extremes that may cause further damage. The plumbing that barely worked in a house that was hardly used by an elderly person is leaking now that you have started conducting regular inspections and that is why you will find failures.

Often the calculation of the real cost of holding and getting an inherited property ready for a typical sale results in very high figures. Besides the urgent repair costs to prevent the worsening of situations, the costs for the updates necessary to make the property saleable, the holding costs during renovations and after until the finalization of the sale, and the costs connected with the sales of traditional properties (the real estate commission and the closing costs), you might find yourself paying thirty, forty, or even fifty thousand dollars before seeing any return. The financial logic of investing more money becomes doubtful when the sale price is only a little bit more than these costs or when the expenses take up most of the anticipated inheritance.

The additional factor that makes capital tied up in repairs and holding costs a big burden is the opportunity cost of the same capital. A dollar spent on the maintenance and improvement of an inherited property is one less dollar available to take care of your needs, be it paying off costly debt, building emergency savings, or investing in opportunities aligned with your financial goals. The months during which you are paying for the inherited property are months when the money is not working for your actual priorities.

Family Conflict Threatens Relationships

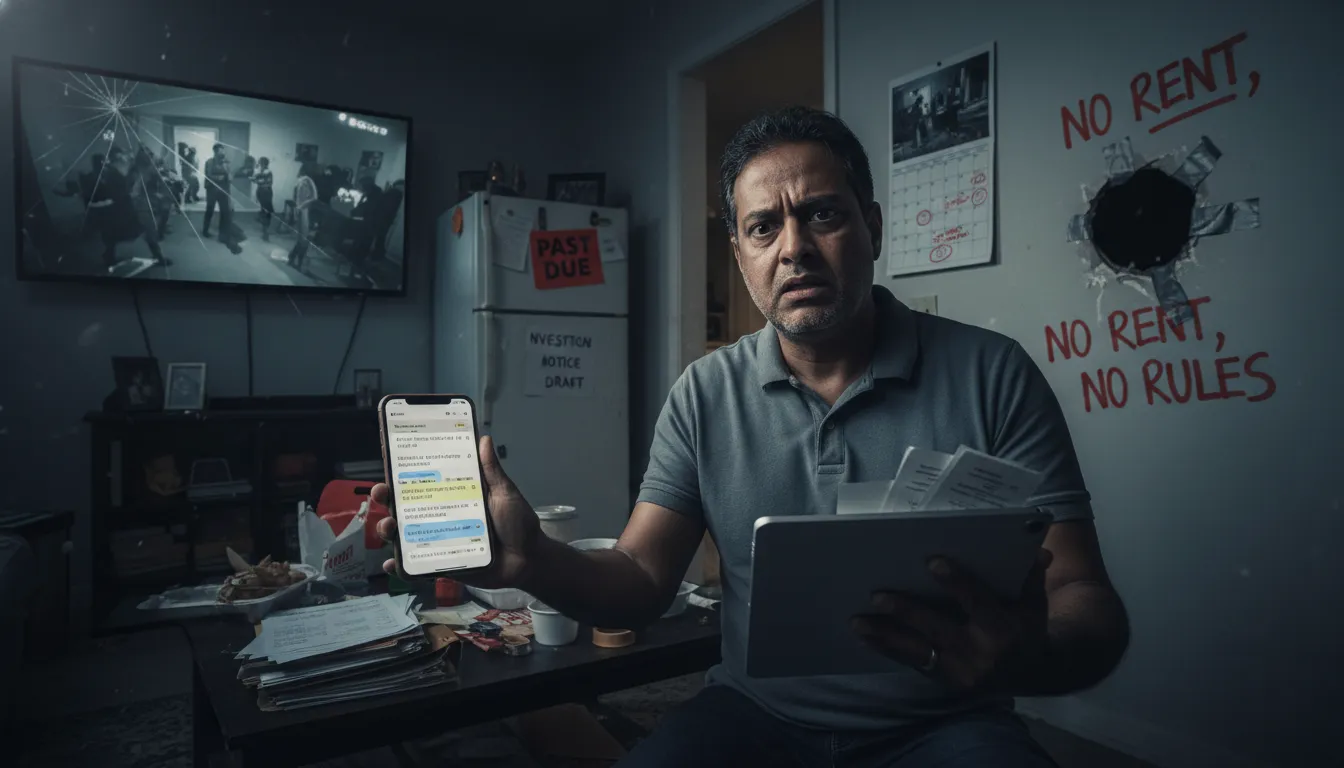

When several heirs share an inherited property, the decision-making process becomes very complicated and can lead to fights within the family of a tragic nature. Brothers and sisters, who usually get along well, argue whether to sell immediately or hold the property. Some of the heirs want their share of the inheritance to be distributed as soon as possible so they can take care of their own financial needs. While others are emotionally attached to the family home and therefore are reluctant to sell it, they are hoping that some member of the family will eventually choose to live there.

The financial burden rarely gets equally distributed among the heirs even if the ownership percentages are the same. Usually, the one sibling who lives nearby takes on the practical responsibility of managing the property, coordinating contractors, handling maintenance emergencies, and dealing with all the details of property ownership which may never end. At the same time, the heirs living in other cities or states contribute financially but are not burdened with the time and stress of property management. This inequality leads to the discontent that destroys the family relationships.

Explore Utah Real Estate

5618 E SOUTH FORK RD, Provo, UT

$43,000,000

Bedrooms: 6 Bathrooms: 10 Square feet: 22,958 sqft

864 W SAPPHIRE SKY LN #546, St George, UT

$4,300,000

Bedrooms: 7 Bathrooms: 9 Square feet: 5,136 sqft

La Casa Cir, St George, UT

$575,500

Square feet: 14,391 sqft

The disagreements about repair priorities and budgets make the situation worse. One of the heirs is willing to undertake extensive updates in order to increase the sale price, whereas the other thinks that minimal repairs are more financially viable. A person proposes that they rent the property so that by the time they are making the decision, at least the property will generate an income, but others are worried about tenant problems and landlord responsibilities. Every decision necessitates the consent of many parties with different viewpoints, priorities, and levels of risk tolerance.

The emotional side of the story of the inherited property makes the practical disagreements even more profound. The house is the place where the childhood memories were made, it is the connection to the people who have passed away and the family history. There are some heirs that have a hard time seeing it simply as a financial asset that is in need of business decisions. There are others who were brought up in the home and selling it is like discrediting their parent's memory. These emotional dynamics make it difficult to talk rationally and almost impossible to make a decision.

Fast sale options solve the problem of family conflicts by getting rid of the property as the source of disagreements that continue over time. As soon as the property is sold and the money is divided among the heirs, each of them can go their own way. The burden that was shared and was the cause of the deteriorating relationships is gone completely, thus enabling members of the family to retain the bonds without the property being a constant source of tension and argument.

Distance Makes Management Impossible

Managing property from afar turns simple tasks into big logistical headaches. What would be a small plumbing leak fixed by a local plumber quickly, now becomes a saga of finding the right plumber from a long distance, coordinating schedules and property access, and hoping that the job gets done correctly without your direct supervision. Every maintenance problem calls for much more time and effort than if it were a property you could personally manage.

Emergency situations throw you into a particularly difficult position when you are handling inherited property from a distance. A neighbor calling to report that the water is flowing from under the front door due to a burst pipe could not be more alarming. Coordinating emergency response from another state, contractors not answering immediately, worrying about the extent of the damage while you are frantically looking for help, that is what you are living right now. Not being able to physically solve problems as they come up creates a feeling of anxiety that spills over into your daily life and work.

Regular inspections that are done locally by property owners in a very casual manner, need planning and money if you are a distant heir. You have to either go periodically to the property to make your own checks or hire property management services to do the inspections. Both ways have a cost in money and time. It feels like a waste of money to pay for the plane and hotel to check an inherited property that you will just sell, but if you don’t inspect, you are taking the risk that issues will escalate before you find them.

Getting the property ready for a standard sale remotely adds to the difficulties of managing it. You are trying to get the contractors to do the work and the updates and at the same time, you have no presence there to be able to confirm the quality. You are trusting contractors who have never met you that they do their work properly and honestly. The distance is stopping you from being able to help immediately when problems are arising during renovation. Easily done projects at your own home if you are a local, become complicated due to necessary extensive coordination and trust in people whom you hardly know.

For those managing inherited properties from far away, working with experienced house buyers in Tampa, FL or other distant locations eliminates the entire burden of remote property management. Quick cash sales transfer the property and all its management headaches to buyers who handle everything locally, freeing you from the stress and expense of managing property across distance.

More Properties You Might Like

1700 W 2700 N #36, Pleasant View, UT

$230,000

Bedrooms: 4 Bathrooms: 2 Square feet: 2,100 sqft

2098 E GOOSE RANCH RD, Vernal, UT

$103,000

Square feet: 274,864 sqft

850 LAZY WAY #8, Francis, UT

$1,300,000

Bedrooms: 4 Bathrooms: 4 Square feet: 2,755 sqft

You Have No Interest in Being a Landlord

Some beneficiaries decide to keep an inherited property as a rental investment, anticipating that it will generate income and increase their wealth gradually. This decision only works out if you are really interested in the landlord's duties and have the necessary work and efforts in mind. The landlord who owns a rental property must choose and screen tenants, collect rent, take care of maintenance requests, manage lease violations, coordinate repairs with contractors, stay updated on landlord-tenant laws, and if the case, initiate eviction proceedings.

Most new property owners are shocked by the time requirements of landlord duties. Tenants' phone calls about maintenance issues come at inconvenient times and require your immediate attention. The time when the property is vacant between tenants, giving you an opportunity to market the property, show it to prospects, and process applications. On an annual basis, lease renewals consist of negotiating new terms and possibly finding new tenants if present ones don't renew. Professional property management may handle daily operations; however, you still make financial decisions, authorize repairs, and bear the ultimate responsibility for the investment's performance.

The financial aspect of being a landlord in the rental property market involves situations where no income is generated for long periods. The time when the property is vacant between tenants is a period in which all expenses are your responsibility, without rental income. A major repair such as a new roof or the breakdown of an HVAC system that requires immediate capital investment, which at times, can be more than the rental income of the last few months. Over time, property taxes and insurance premiums may rise, thus eating more significant portions of rental income. The so-called passive income turned out to be more of a theory than it actually is.

Being emotionally attached to the property that has been passed on to you may interfere with your judgment of whether a rental investment makes sense from a practical point of view. You might feel it as a duty to keep the family home rather than selling it, even though the logical analysis shows that rental ownership is not consistent with your financial goals and lifestyle. Don't let the feeling of guilt about selling the house where you were raised be the reason investing in something else that will affect your financial wellbeing for the next years.

Making Peace with the Decision

Choosing to liquidate an inheritance promptly instead of keeping it indefinitely is not indicative of the fact that you didn't love the person who left it to you. It doesn't show disrespect to their memory or indicate that you are greedy. It simply acknowledges that the property has become a burden rather than a blessing, and that your wellbeing matters more than holding on to a house that is harming your finances, relationships, and peace of mind.

Quick transactions offer neat endings that make it possible for you to move on instead of being stuck with property that requires your constant attention and resources. The value of the inheritance changes from an illiquid, burdensome asset into money which you can actually spend according to your needs and priorities. You are relieved from the stress of property management, the family feud is resolved through the distribution of the proceeds, and the emotional burden of being responsible for someone else's home is lifted off your shoulders.

The choice to go for a quick sale is made more obvious when you take an honest look at the financial drain, family dynamics, management difficulties, and your real lack of interest in owning property. Not all inherited properties warrant prolonged attempts at theoretically maximizing sale prices. There are times when the wisest decision is to take the offer at its word and let it go quickly, thus keeping your financial health and the good relations in your family intact instead of sacrificing both for the sake of holding onto a property that doesn't serve the genuine interests of anyone.