Any homeowner who plans to put their home on the market will sooner or later have to decide whether it makes sense to do some fixing up before selling or to simply sell the house as-is. It is a question that troubles people a lot, particularly when the place is in a bad condition. Sometimes the solution is not straightforward, and if you happen to choose wrongly, you may lose thousands of dollars or a few months of your time. Finding out the right way to figure out if fixing up the house is financially feasible entails knowing important factors that exceed basic mathematical operations.

Understanding the Return on Investment Principle

Return on investment is, basically, the main idea behind any repair decision. The calculation which is made in theory, is direct: if you put five thousand dollars into repairs and the sale price results are increased by eight, the decision you made is a successful one. The math, however, is far more complicated than that simple equation, when it comes to practice.

Firstly, complexities wrap around layers of accurately estimating both costs and returns. As a rule, homeowners underestimate repair costs, and that is usually by a large margin. What is the starting point as a price of three thousand dollars for the kitchen updates, can turn into five or six thousand when you find hidden issues, meet code requirements, or decide to upgrade materials halfway through the project. The reason is that even professional contractors cannot give perfectly accurate estimates, because old houses are often full of surprises behind the walls and under the floors.

As difficult as that is, figuring out how many repairs will actually add to the value is just as challenging. One may think that a ten-thousand-dollar bathroom renovation would increase the home's value by at least that much; however, market factors, neighborhood trends, and buyer preferences all affect the real influence. In some markets, buyers just take for granted updated bathrooms and will not pay extra for them. In others, they will be willing to pay a lot more for a house that is ready to move in. Knowing your exact market dynamics is a must if you want to make the right projections.

The Time Factor That Everyone Overlooks

Most sellers when calculating whether mending is worth, limit their attention to only dollars in versus dollars out. They miss, however, that one of the most huge costs in the real estate industry, is time. Every week that goes by when you are fixing the house, represents the costs of holding the property, which are eating little by little your profits. Mortgage payments, property taxes, and insurance will continue as usual whether your home is on the market or under renovation, likewise, utilities and maintenance.

Imagine a truly instance where you choose to put fifteen thousand dollars into repairs that will take two months to complete. Your holding costs during those two months may be around four thousand dollars. Then you put the property on the market, and it takes another month to find a buyer and another month to close. So, that is four months of expenses totaling eight thousand dollars. When you take into consideration the extended timeline, the fifteen thousand dollar repair investment that you made is now effectively costing you twenty-three thousand dollars.

The lost opportunity money is more than just financial carrying costs. The delay to sell can cause you to lose some other opportunities. Maybe there is a job offer in another state that you cannot fully commit to because your house isn't sold. Perhaps there is a perfect property you like to buy, but you cannot make an offer until your current home sells. Maybe you are going through a divorce or experiencing financial difficulties, and every month of delay adds to your stress and problems. These intangible costs are real even though they do not show up on a spreadsheet.

Buyer Pool Considerations and Market Reality

Different kinds of repairs will attract or repel different kinds of buyers, and knowing this interaction is the key to making wise decisions about repairs.

By and large, home buyers who are looking for move-in-ready homes and are willing to pay a premium price for the convenience will be attracted by cosmetic updates such as a fresh coat of paint, new flooring, and modern fixtures. These buyers usually go for conventional financing and bring in inspectors who examine every single detail.

Explore Utah Real Estate

5618 E SOUTH FORK RD, Provo, UT

$43,000,000

Bedrooms: 6 Bathrooms: 10 Square feet: 22,958 sqft

864 W SAPPHIRE SKY LN #546, St George, UT

$4,300,000

Bedrooms: 7 Bathrooms: 9 Square feet: 5,136 sqft

La Casa Cir, St George, UT

$575,500

Square feet: 14,391 sqft

On the other hand, significant structural repairs, revised electrical systems, new roofs, or foundation work are considered as a different category of changes. Such repairs don't normally raise your home's attractiveness to retail buyers because they are not visible or sexy. What they do, however, is just ensuring that your property meets the minimum standards that lenders and inspectors require. Putting a lot of money into these necessary but unattractive parts of your home might make it possible for it to be financed, but it won't necessarily get the attention of buyers who are willing to pay a lot more.

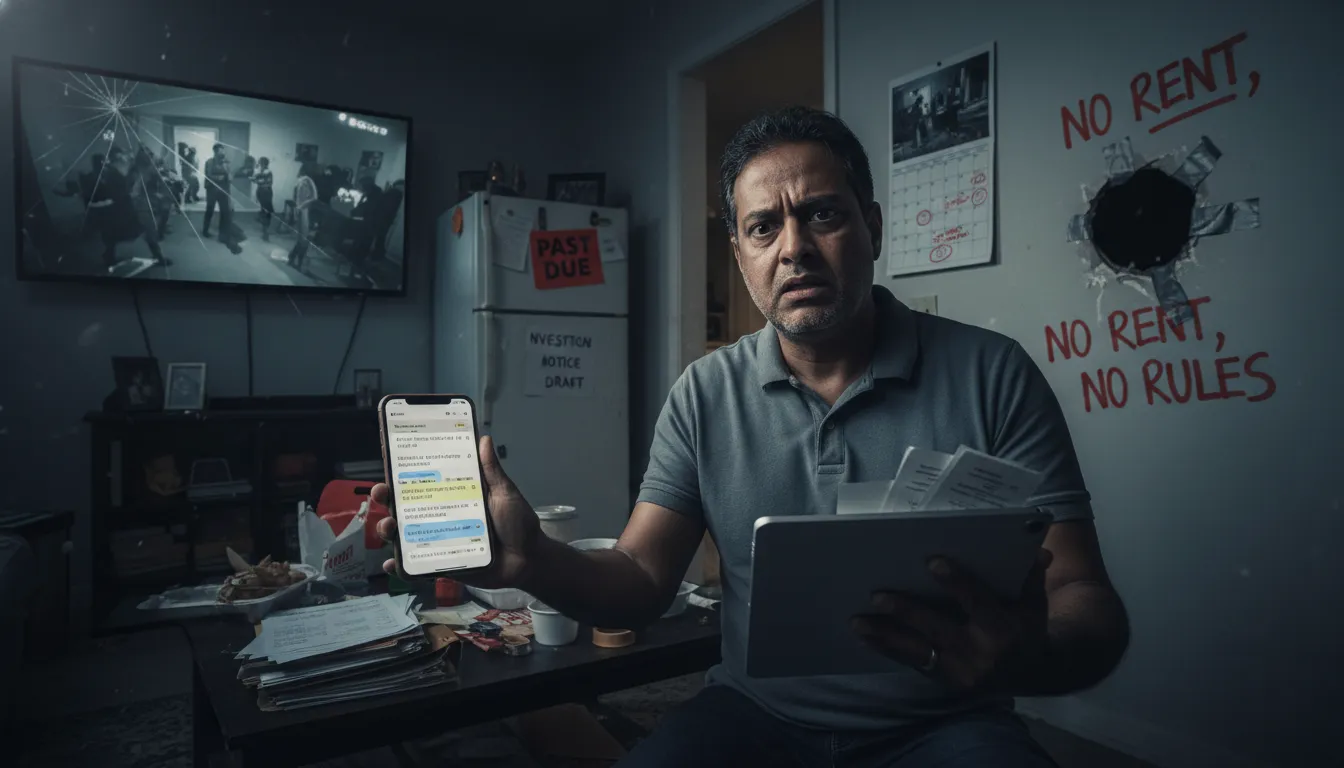

For properties that need substantial work, especially those facing foreclosure or other distressed situations, the traditional retail buyer pool might not be realistic regardless of what repairs you make. In these circumstances, understanding how to sell your foreclosure house without extensive repairs might be the most financially sound path forward. Investors and specialized buyers actively seek properties they can renovate themselves, and they base their offers on the current condition, not on repairs you might make.

Creating Your Personal Break-Even Analysis

If you want to find out whether it makes financial sense for you to fix a certain thing, you have to develop a detailed break-even analysis considering all factors. Firstly, for any repair work you might do, obtain at least three quotes from different licensed contractors. From the highest quote, add twenty percent to act as a reserve for unforeseen situations. Thus, you get a realistic worst-case scenario for repair costs.

After that, study the sales of the similar properties in your street or area to check the price differences between renovated and unrenovated properties. Check out the houses that were sold within the last six months and have a similar square footage and are in a similar location. Calculate the price differential between the updated homes and the ones sold as-is. This difference is the maximum extra value you can realize through the repairs, although you should remember that you will probably only get a little bit more than half of the total difference.

More Properties You Might Like

1700 W 2700 N #36, Pleasant View, UT

$230,000

Bedrooms: 4 Bathrooms: 2 Square feet: 2,100 sqft

2098 E GOOSE RANCH RD, Vernal, UT

$103,000

Square feet: 274,864 sqft

850 LAZY WAY #8, Francis, UT

$1,300,000

Bedrooms: 4 Bathrooms: 4 Square feet: 2,755 sqft

Consider your carrying costs by figuring out your monthly expenses such as mortgage, taxes, insurance, and utilities, and then multiply it by the number of months you think repairs will take plus the time that the house will be on the market. Add this number to your repair costs to get your total real investment. Compare this total investment with the possible increase in sale price to calculate your actual net return.

The Competitive Landscape Analysis

Your repair decisions should be interconnected with your market conditions. You can't simply assume what will happen if you just make a repair decision. Let's say there are ten other similar homes for sale in your neighborhood. Out of those ten, eight are recently updated. In such a scenario, you probably need to make repairs just to be on a level playing field. On the contrary, if almost all of the comparable properties are also old or require some kind of work, then it might be that a thorough repair will bring you only a little competitive advantage, or maybe even none at all.

You can find out what is currently available by visiting open houses or looking at online listings in your area. Notice the amount of time that properties have been on the market and check whether the prices are fluctuating or not. In a hot seller's market where properties get off the market very quickly no matter what their condition is, it might not be necessary to undertake an extensive repair. Conversely, in a slow buyer's market where there is a lot of inventory, repairs can help your property attract attention but at the same time, they might not be able to lift the property above the market challenges.

It would be a good idea to also take into account the price point you are aiming at. For instance, luxury market buyers expect everything to be in perfect condition and they have the means to be very particular. Even a small imperfection can be the cause of a significant price cut or losing the sale. Whereas in the lower price tiers, buyers are more likely to take on the responsibility of the work themselves and hence, they are more tolerant of minor cosmetic issues. By knowing the expectations at your precise price point, you will be able to figure out which repairs are necessary and which ones are just optional.

Making the Decision With Confidence

After you collect all this data, it is hardly the case that you will find a straightforward solution that makes the decision very clear. Usually, you will see a spectrum of different results depending on the assumptions made. At this point, you have to assess your personal risk tolerance, timeline requirements, and financial capacity.

Perhaps, with a nice pile of savings, time being on your side, and a strong belief in your market, it could be the case that making strategic repairs is the right move. In case you are under time pressure, have limited capital, and there is market uncertainty, it might be better to sell as-is to a direct buyer even if the offer is lower than you expected. The best decision is that which is consistent with your particular situation and objectives rather than the one that appears to be the best in a theoretical calculation.

Do not forget that housing markets are volatile by nature. Even the most rigorous analysis is based on assumptions that may not turn out to be true. Sometimes, the most important calculation is not finding the maximum possible return but rather the one that allows you to minimize risk and have certainty when you need it most.