Overview: A State Rewriting Its Map

Utah is experiencing one of the most transformative growth spurts in recent memory. From new high-rise towers reshaping downtown Salt Lake City's skyline to whole communities replacing farmland along the Wasatch Front, development is accelerating across multiple corridors. The shifts are being driven by job growth, a young and expanding population, and major infrastructure upgrades. Understanding the eight major growth zones gives buyers, sellers, and investors the context needed to make strategic decisions over the next five to ten years.

1. Downtown Salt Lake City: Vertical Growth and Increasing Density

Salt Lake City's core is becoming denser and more residential. New high-rise towers, mixed-use developments, and entertainment complexes are turning downtown into a place where people live, work, eat, and play rather than only commute through. Geographic constraints—the Wasatch Mountains, the Great Salt Lake, and Utah Lake—make vertical growth the logical path. Improved airport capacity and transit expansions are strengthening global and regional connections, increasing demand for downtown condos and rental units.

2. Southwest Corridor: Master-Planned Neighborhoods and Transit Hubs

The southwest corridor, including Daybreak in South Jordan and Herriman, is a showcase for large-scale master-planned communities. Builders are delivering entire neighborhoods at pace to meet demand. These areas emphasize walkability, sustainability, and integrated amenities—features now expected by many homebuyers. Major road projects such as the Mountain View Corridor are improving commute times and tying these suburbs into the broader valley, which supports long-term land appreciation.

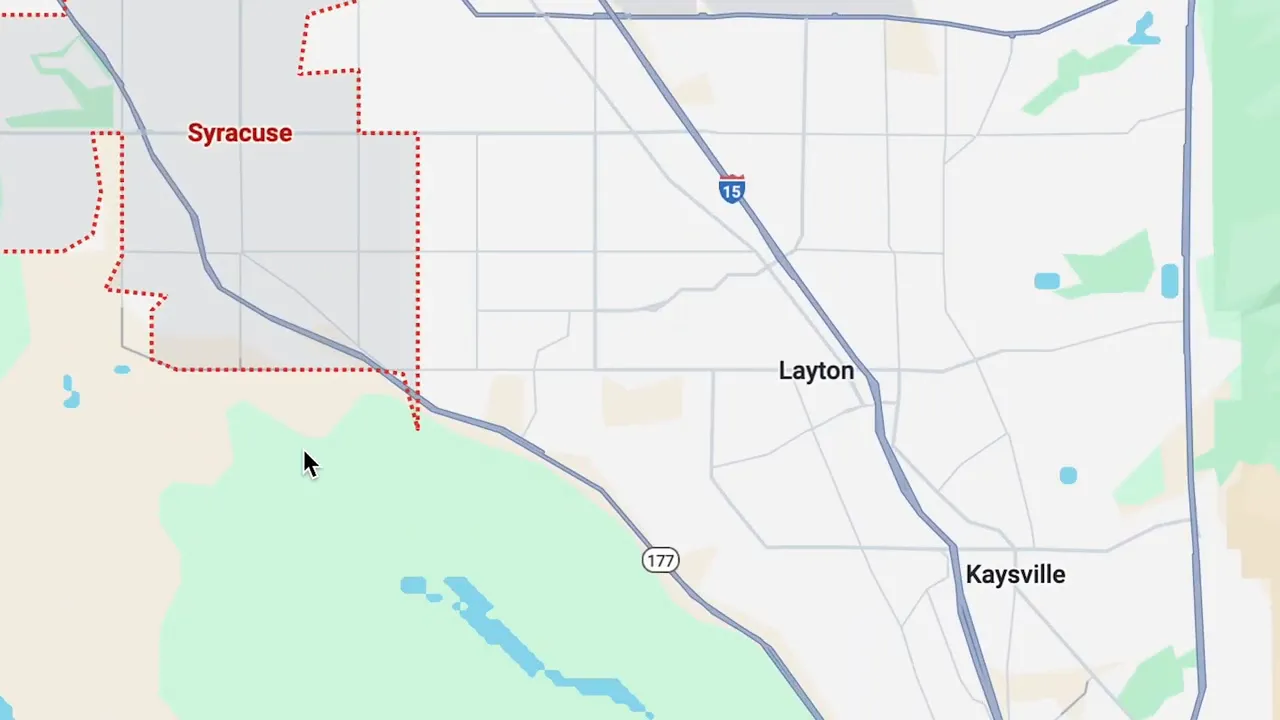

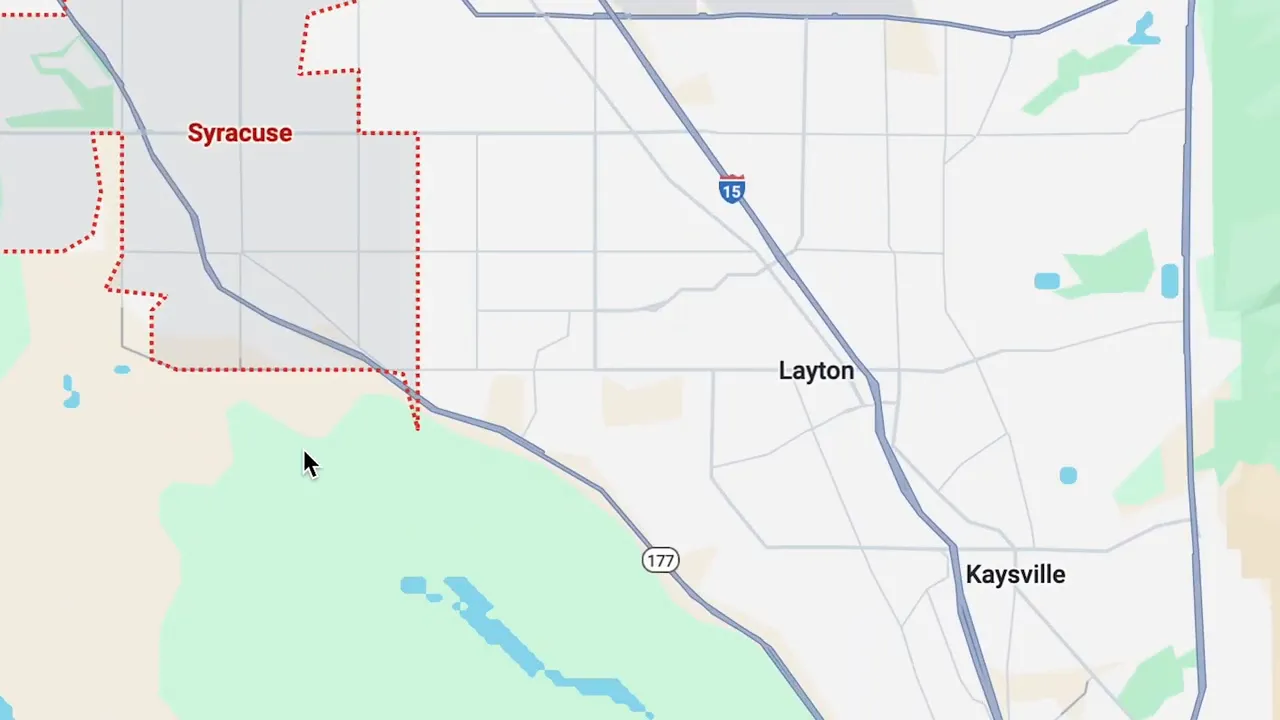

3. Northern Growth: Syracuse, West Haven, and Northern Valleys

Connectivity north of Salt Lake City is improving through projects like the West Davis Corridor. Syracuse and West Haven are expanding from farmland into residential, commercial, and logistics hubs. North Ogden and suburbs near Hill Air Force Base benefit from mountain access, outdoor recreation, and defense-related employment from contractors such as Northrop Grumman and Lockheed Martin. For buyers priced out of central Salt Lake County, these northern suburbs offer relative affordability with growing infrastructure and employment options.

Explore Utah Real Estate

653 E RYEGRASS DR #305, Eagle Mountain, UT

$387,900

Bedrooms: 3 Bathrooms: 3 Square feet: 1,985 sqft

6668 S 3200 W, Spanish Fork, UT

$2,199,999

Bedrooms: 3 Bathrooms: 3 Square feet: 2,560 sqft

1500 FISH CREEK RD, Bancroft, ID

$1,100,000

Bedrooms: 6 Bathrooms: 4 Square feet: 3,767 sqft

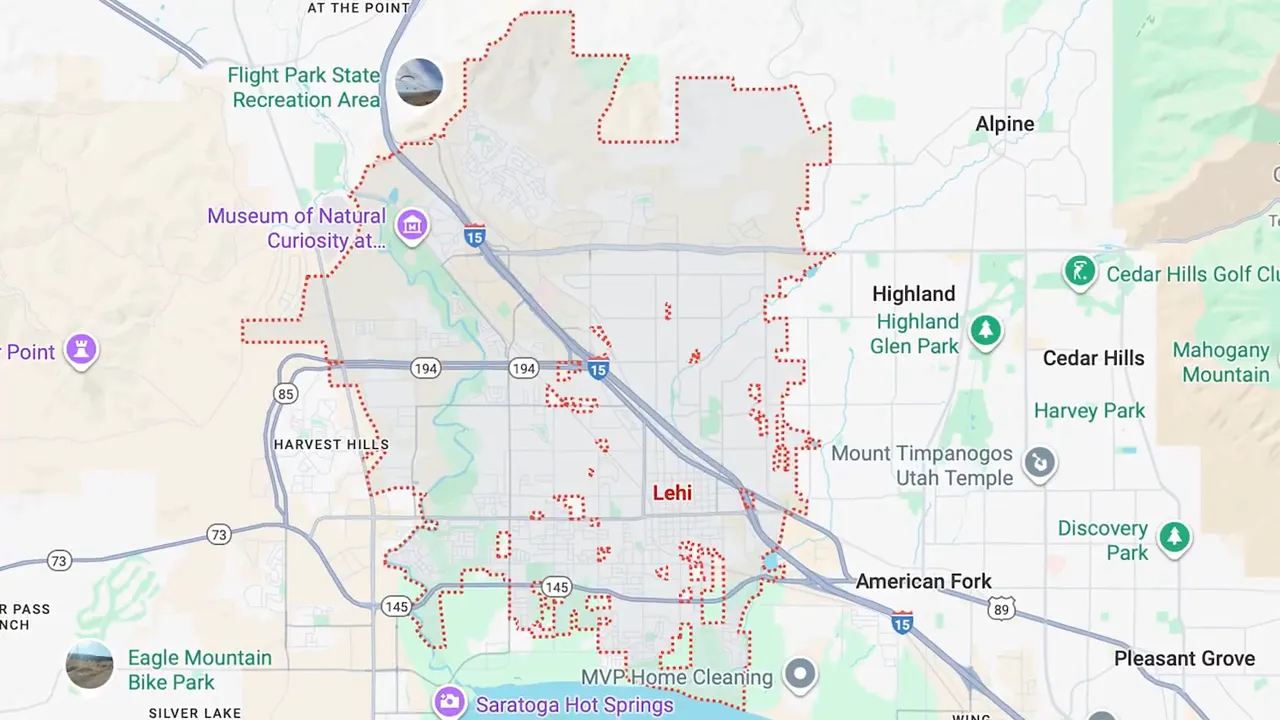

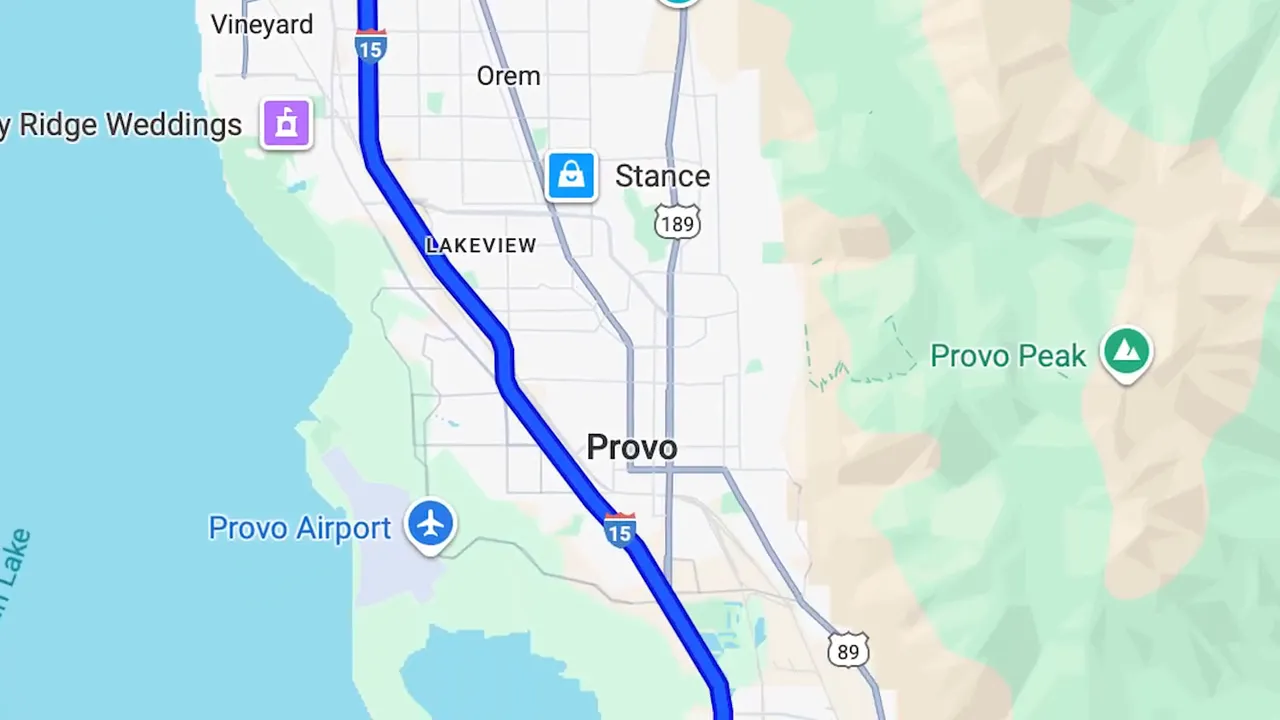

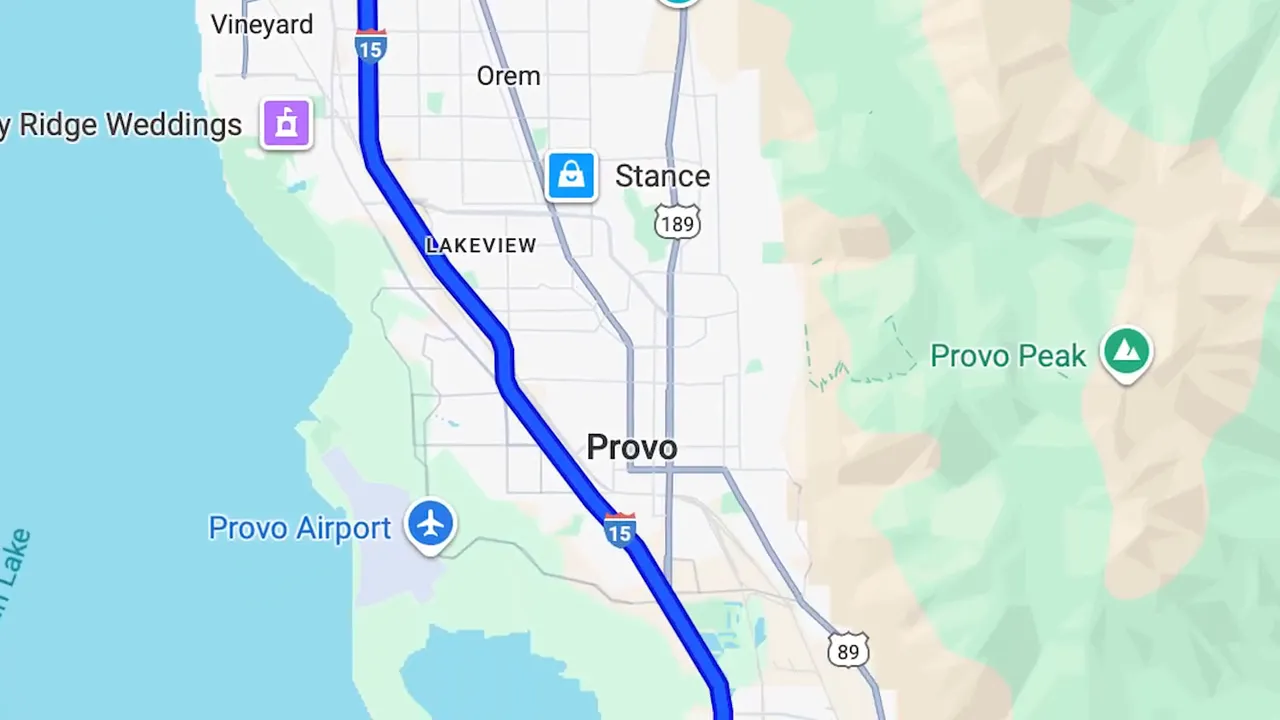

4. Utah County and the Silicon Slopes: Jobs Turn Into Lifestyle

Utah County has evolved beyond being strictly a job engine. Lehi remains the heart of the Silicon Slopes tech economy, driving significant employment growth. American Fork is repositioning its downtown and transit options, while Vineyard is transforming former industrial land into lakeside neighborhoods with thousands of homes. Long-term projections suggest Utah County's population could approach parity with Salt Lake County in coming decades, creating major opportunities for buyers seeking job proximity, educational infrastructure, and lifestyle amenities.

Relevant resources: information on buying new construction in Utah can help buyers navigate options in fast-growing communities: https://bestutahrealestate.com/news/buying-new-construction-homes-in-utah-in-2025

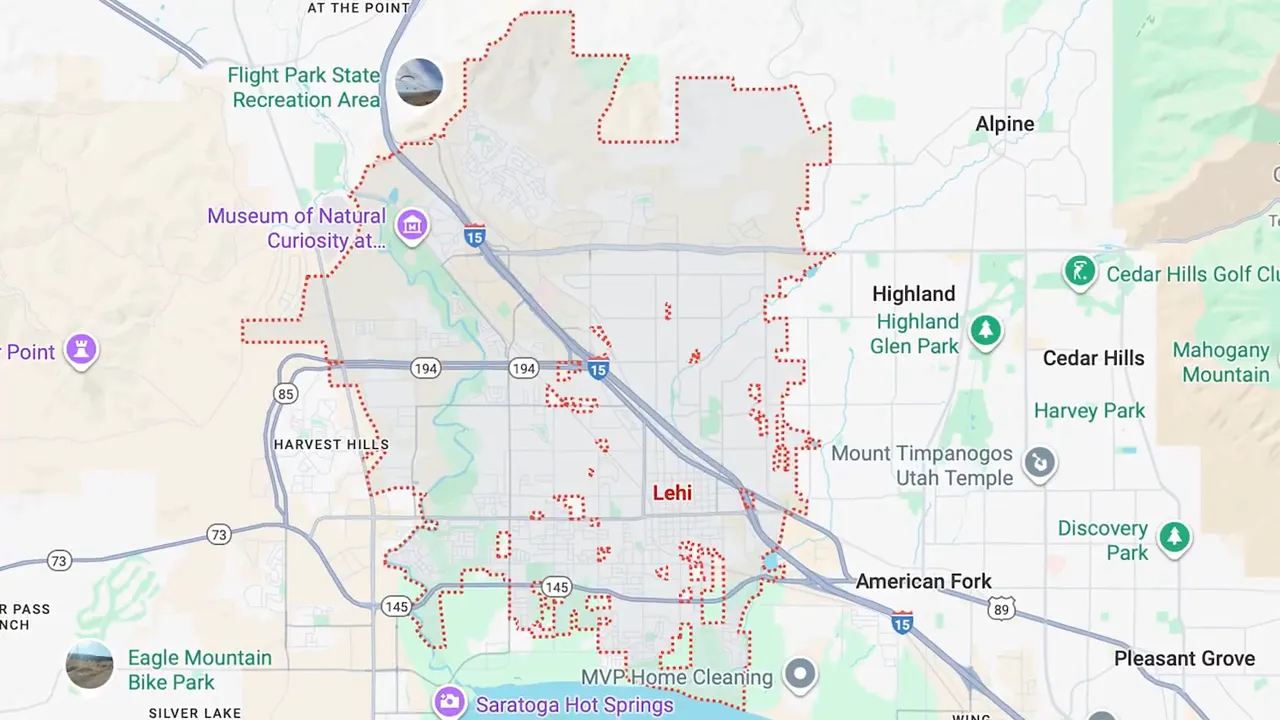

5. Outer Rings: Eagle Mountain, Saratoga Springs, and Land-Rich Opportunities

Areas farther from the core offer the largest parcels of developable land. Eagle Mountain is planning over 8,000 homes and infrastructure including tech data centers. Saratoga Springs now benefits from improved freeway access. These outer rings suit investors with five to ten year horizons because entry costs are lower and long-term upside is higher as infrastructure arrives.

6. Southern Utah County: Spanish Fork, Springville, and Mapleton

The south end of Utah County is moving fast. Spanish Fork is attracting retail and employment centers. Springville landed the state’s first Buc-ee’s, a signifier of increased highway traffic and regional investment. Mapleton is drawing luxury buyers with large lots and mountain views, frequently featured in the Parade of Homes. These communities are compelling for families seeking larger homes, quality schools, and proximity to outdoor recreation.

7. Wildcards: Tooele County, St. George, and the Wasatch Back

Wildcard zones are places that were once peripheral but are now gaining traction due to new infrastructure and changing lifestyle preferences. Tooele County recorded one of the fastest growth rates in the state after improved I-80 access. St. George and Washington County continue to boom beyond traditional retiree demographics, attracting families, remote workers, and lifestyle seekers. Mountain-front and canyon towns such as Morgan and Heber City on the Wasatch Back offer recreation access with a small-town feel and new construction opportunities for those priced out of Park City or the Salt Lake Valley.

More Properties You Might Like

86 S 950 E, Hyde Park, UT

$774,900

Bedrooms: 6 Bathrooms: 4 Square feet: 3,544 sqft

LOOKING GLASS RD, La Sal, UT

$998,100

Bedrooms: 3 Bathrooms: 1 Square feet: 792 sqft

216 W RIDGE RD, Saratoga Springs, UT

$309,999

Bedrooms: 3 Bathrooms: 2 Square feet: 1,196 sqft

City-specific information for those considering Southern Utah options is available at: https://bestutahrealestate.com/news/st-george/market-reports/st-george-real-estate-market-report-june-2024

8. What Is Driving the Change?

The modern growth engine in Utah is a mix of demographic momentum and economic opportunity. Utah has one of the fastest-growing state populations and the youngest median age in the nation, producing a durable base for housing demand. High birth rates, inbound migration, strong job creation—especially in technology and defense—and structured infrastructure investments are aligning to redirect growth across multiple corridors. At the same time, buyer preferences are shifting toward walkable neighborhoods, easy access to nature, and community-driven design.

For those seeking supporting data on population trends, the U.S. Census offers up-to-date statistics: https://www.census.gov

How This Matters by Goal

- Short-term buyers should prioritize affordability and immediate access to schools and jobs.

- Five-to-ten-year investors should evaluate land availability, planned infrastructure, and job pipelines in outer-ring communities.

- Relocating families should weigh neighborhood amenities, commute options, and school quality when choosing between central urban living and master-planned suburbs.

Actionable Steps for Buyers and Investors

- Map job growth corridors and transit projects to identify areas with likely demand increases.

- Consider master-planned communities for walkability and built-in amenities.

- Factor in five- to ten-year infrastructure timelines when targeting outer-ring investments.

- Leverage resources about purchasing new construction and investment strategies to understand builder timelines, warranties, and resale dynamics: https://bestutahrealestate.com/news/unlocking-opportunities-in-utahs-new-construction-real-estate-market

- Monitor local market data and national industry reports for timing and interest rate context (for example, National Association of Realtors market insights): https://www.nar.realtor

Where to Learn More and Plan the Move

Comprehensive relocation guidance and market reports are available for prospective movers and investors. For general relocation planning, including cost of living and neighborhood overviews, see: https://bestutahrealestate.com/news/moving-to-utah-everything-you-need-to-know

Recommended Reading and Resources

Final Considerations

Utah's market is shaped by a powerful combination of demographic growth, job creation, and deliberate infrastructure investment. The next decade will likely reward those who align purchase timing with the right growth story—whether that means downtown density, master-planned suburbia, or strategic outer-ring bets. Prospective buyers and investors should prioritize long-term infrastructure plans, employer corridors, and neighborhood livability when deciding where to commit capital.

Frequently Asked Questions

Which areas are best for tech jobs and short commutes?

Lehi and surrounding Silicon Slopes communities remain the strongest tech job centers. American Fork, Orem, and parts of northern Utah County provide relatively short commutes to major employers and growing transit options.

Are the outer-ring towns like Eagle Mountain and Saratoga Springs good long-term investments?

Outer-ring towns offer lower entry prices today and strong long-term upside as freeway access and data centers arrive. These markets are best suited to investors with a five- to ten-year time horizon and tolerance for longer infrastructure timelines.

How quickly is downtown Salt Lake changing compared with suburbs?

Downtown Salt Lake is changing through vertical densification and mixed-use projects, driven by limited land availability. Suburbs are changing via horizontal expansion, master-planned communities, and infrastructure investments. Each type of growth attracts different buyer profiles and investment dynamics.

What should families prioritize when choosing between Salt Lake County and Utah County?

Families should prioritize proximity to jobs or schools, the quality of local districts, neighborhood amenities, and commute times. Utah County offers strong tech employment and rapidly expanding lifestyle options, while Salt Lake County provides more urban amenities and transit options.